Introduction to Impact Investing

To put it simply, impact investments are investments made to generate positive, measurable social and environmental returns along with commercial returns. Impact investing has characteristics which challenges the narrative of investments being exclusively focussed on achieving a financial return. Impact investing challenges the conventional reliance on philanthropic donations to address social and environmental challenges, that is introducing a capital market for “good”. Commercial financial returns remain very important while seeking to make measurable impact in other aspects. Impact investing can take the form of equity and/or debt capital.

Key Role Players

The incentive for investors is not only to extend their strategic corporate social responsibility but rather to open doors to a market of creatively diverse and sustainable opportunities. Attraction comes from various types of investors including:

- Banks, pension funds, financial advisors, wealth managers

– Providing client investment opportunities;

- Institutional and Family Foundations

– Leveraging assets to advance their core social/environmental goals;

- Government Investors and Development Finance Institutions (“DFIs”)

– Providing proof of financial viability for private-sector investors.

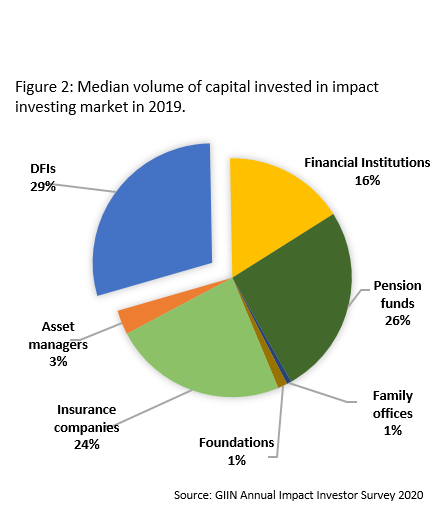

The Global Impact Investing Network (”GIIN”) note that DFIs reported to have the highest median amount of capital invested in Impact Markets in 2019 (USD273 million), as per Figure 2, and plan to increase this by c. 80% in 2020.

United Nation’s Sustainable Development Goals

The United Nations (“UN”) proposed a set of 17 Sustainable Development Goals (“SDGs” or “Global Goals”) being highlighted as the backbone of the impact investing market. These goals consist of 169 targets and 232 indicators, to address the world’s most challenging social and environmental issues, wherein the SDGs cover a significant variety of themes. These themes include sectors like sustainable agriculture, renewable energy, microfinance, and access to affordable basic services such as housing, healthcare and education.

An important aspect of the SDGs is that they are not mutually exclusive, meaning an impact created in one Global Goal will amplify impact by benefitting another – somewhat like a snowball effect. It is therefore paramount to understand the complexities associated with the SDGs to obtain a desired outcome.

State of the Impact Investing Market

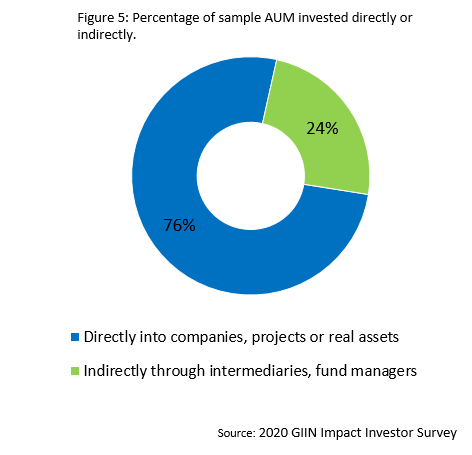

Impact investing may be a relatively new term to some investors. The market consists of investments across multiple asset classes, sectors, and regions. In the 2020 GIIN Survey (“the survey”), an updated market sizing analysis estimates the current market size at USD715 billion. The analysis examines the supply of capital allocated to impact investing as at the end of 2019, using impact investing assets under management (“AUM”) as the indicator of market size. The GIIN estimates that over 1,720 organizations manage the estimated USD715 billion AUM as at the end of 2019.

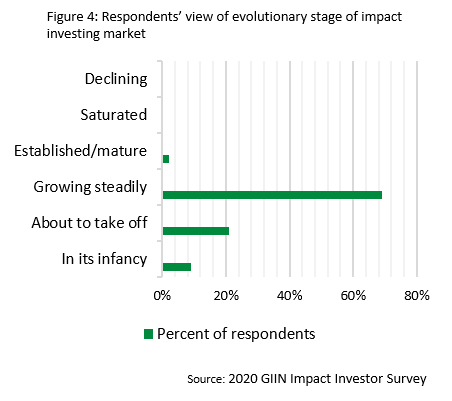

While this market is relatively young, the survey indicates investors have an overall optimistic outlook about its development, expected increase in scalability and efficiency in the future. Some investors have been making impact investments for decades, whilst others have recently emerged. Increasing activity represents the start of a collaborative international effort to accelerate the development of a high-functioning market that supports social change.

In South Africa

Over the past decade South Africa (“SA”) has implemented enabling policies for the impact investing market. For instance:

- The Code for Responsible Investing in South Africa (“CRISA”) launched in 2011 – provides guidance to institutional investors on executing investment activities in a way that encourages effective governance.

- SA put together a Venture Capital Company (“VCC”) tax regime in 2009, to allow companies and trusts to invest in VCCs in order to reduce their income taxes, by encouraging domestic investment. Since its inception, more than a hundred registered VCCs have raised over USD240 million for domestic small and medium-sized enterprises (“SMEs”).

- The amended Pension Fund Regulation 28 in 2011 – to facilitate greater consideration of Environmental, Social and Governance (“ESG”) factors in investment selection.

- In 2019, the SA Government launched the SA SME Fund which seeks to allocate funding to incubation programs, growth-stage investments, and impact investments.

As of 2019, in support of the amended Pension Fund Regulation 28, SA issued guidance notes to pension funds on incorporating and reporting on ESG factors. South Africa has made effort in enabling a cohesive environment for developing and incentivising activity in the impact investing market.

Merchantec Capital’s role in Impact Investments

Merchantec Capital is a leading corporate finance, independent equity and debt sponsor, research and business advisory company based in Johannesburg, South Africa. Merchantec Capital has identified a purpose in contributing to the broader scope of advancing opportunities that address the world’s most challenging social and environmental issues. Our expert advisors bring value by facilitating and guiding role players in the impact investing landscape. We provide in depth domestic insights, precise research and leverage our vast network to provide a collaborative partnership and successfully raise additional capital for our clients from Impact Investors.