Financial Services Sector M&A Activity Trends 2020 vs 2019

2020 was a challenging year globally, however the financial services sector showed remarkable resilience, despite the adverse impact of the COVID-19 pandemic. This was certainly reflected in the number of global M&A transactions announced in the financial services sector – overall, the total number of transactions announced during 2020 in the financial services sector was down 9%. This number is remarkable, as we expected the reduction in global transactions announced to be bigger, given the lock-downs worldwide and the time required to conclude transactions.

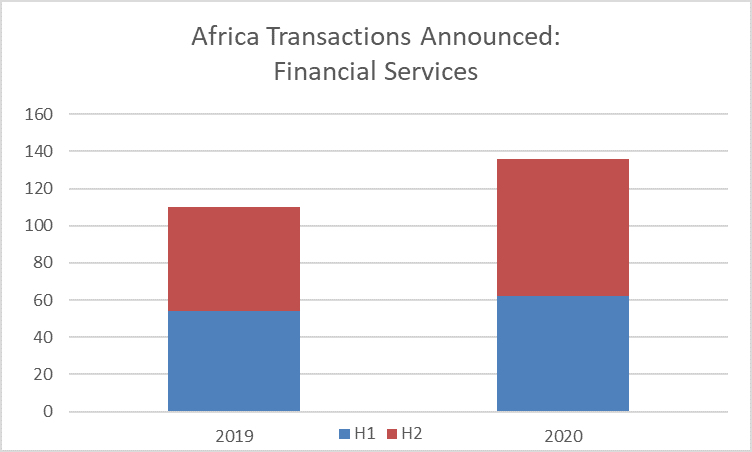

Surprisingly, the total number of transactions announced on the African continent increased by 24% in aggregate, with the second half of 2020 showing growth of 32%, compared to the same period during 2019.

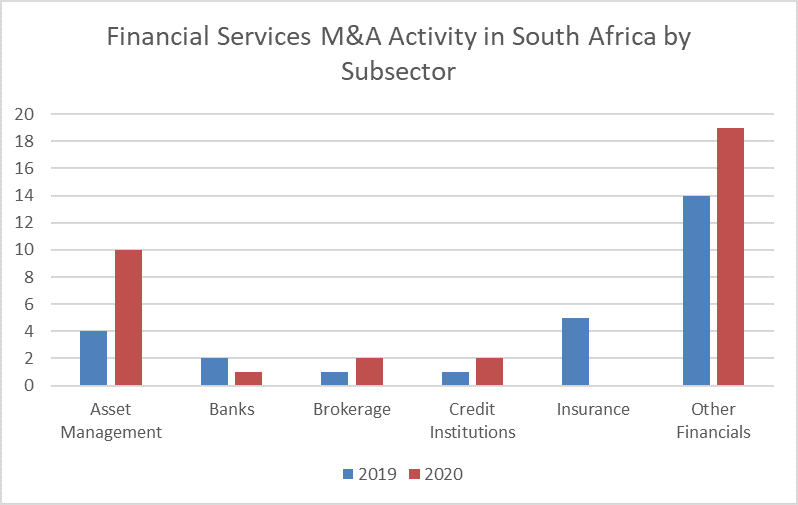

M&A activity in South Africa showed even stronger growth than the rest of Africa, with overall growth of 26% reported. The level of South African inbound, cross-border transactions remained consistent with the prior year at circa 15%. This is a good indication that companies in the financial services sector have shown resilience during the pandemic and are therefore attractive to buyers. We expect to see this trend continue into 2021.

Sub sectors in the financial services space that fared particularly well included asset management and other financials (which comprises of firms that fit into more than one sub sector category). African Rainbow Capital spent some time in the spotlight with its proposed acquisition of 25% of Sanlam’s third-party asset management business, and an increase of its stake to circa 34% in Alexander Forbes.