Industry Outlook

As the global capacity of renewable energy grows hastily in the effort to decarbonize power generation to meet net-zero targets. Acquisitions for renewables have been rising substantially and have become ever more critical to the long-term goals of major players in rebalancing their carbon portfolios, strengthening ESG assets, and greening their operations. With competition for deals increasing, successful M&A has become more difficult to achieve. Strong M&A activity within the sector has helped make renewables a highly contested industry. The number of players active in renewables development and the diversity of the competition has increased significantly in recent years.

Importantly, many competitors have shown that M&A is a core part of their strategy, albeit for different strategic reasons. While many independent renewables developers and utilities have acquired players primarily to increase their scale, add pipelines, and enter new markets. Such as capitalising on opportunities in smart grid technologies and distributed storage. New market entrants such as oil and gas majors, mining houses and financial institutions have also used acquisitions to expand capabilities and enhance their value chain positions, leading to a huge demand for renewable energy platforms and projects. This has seen a gradual transition of renewable energy asset ownership away from integrated utilities towards many different investors willing to take on the risk and rewards of privately owned renewable energy projects.

Oil and gas companies have been refocusing dealmaking activity from building resilience amid COVID-related uncertainty to building a new core of clean energy technologies and initiatives away from traditional hydrocarbon-focused investments. Such as Occidental Petroleum acquiring solar generation assets through its subsidiary Oxy Low Carbon Ventures to directly power an enhanced oil recovery field operation in the Permian Basin, and Suncor Energy investing in carbon capture technology company Svante completing one of the largest single private investments into point source carbon capture technology globally.

Repositioning portfolios for the energy transition also entails the divestments of non-core and high-carbon assets. Divestures are a key part of portfolio strategy to put returns towards core business and future growth. Such as Shell which sold acreage in the Permian Basin to ConocoPhillips in a move to help accelerate the company’s portfolio shift driven by the energy transition, and BP’s divesture of its approximate 20% stake in Russian oil producer Rosneft in response to the conflict in Ukraine and resulting sanctions.

With realizing acceptable risk-adjusted returns becoming more challenging. As investors seek to optimize returns, they will consider new business models, sub-sectors, emerging technologies, and approaches that go beyond traditional norms. More and more companies are carving out new growth assets that take advantage of the energy transition opportunities. There are now many substantial active acquirers among financial institutions, utilities, and independent renewables developers, as well as a considerable number of acquirers that are not part of any of these sectors and a large share of the oil and gas majors.

Global M&A Transactions

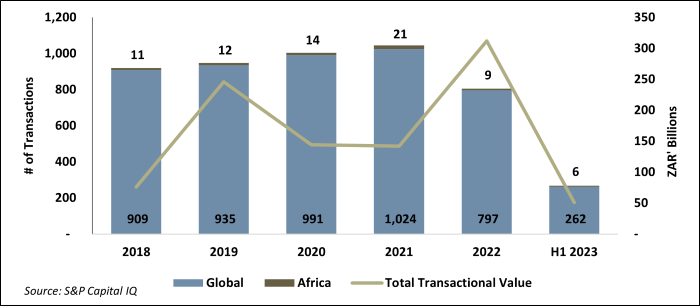

Above is an illustration of the recent publicly known global and regional M&A Activity within the renewable energy space. Including asset transactions, more than 4,500 M&A transactions have been completed between 2018 and the first half of 2023 in the renewables space globally. Although there has been a downward trend in terms of volume year-on-year, this has been accompanied by a steep increase in deal value per transaction. The upward trend in M&A deal value is occurring in multiple regions. Europe has experienced the bulk of global activity with approximately 43% of transactions involving a European based target. North America is the second-largest market followed by Asia-Pacific then Africa.

Robust demand for renewable energy assets, portfolios and platforms was supported by ESG considerations and aggressive decarbonization objectives. While deal value grew, 2022 was the first year where the industry had not experienced growth in installations. Both solar and wind project deployment falling in 2022 compared to 2021. With only battery storage seeing increases in deployment, project valuation and transactions compared to the prior year as significant pre-construction storage entered the market in Q3 and Q4. This was primarily due to project delays and margin pressure from industry headwinds that included disruptions to supply chains, trade developments, interconnection queue bottlenecks, skyrocketing interest rates, labour shortages, and policy uncertainty. The introduction of the Inflation Reduction Act in the US spurred several sales at the end of 2022. Additionally, renewable investors not only continued to move up the value chain in search of financial returns but also diversified into emerging subsectors, such as Renewable Natural Gas (“RNG”), alternative fuels and standalone storage. Notably, RNG transaction volume more than doubled in 2022

Notable global transactions

German energy producer RWE Clean Energy’s acquisition of Con Edison Clean Energy Businesses for $6.8 billion

KKR & Co’s acquisition of French renewables company Albioma for $2.75 billion

Hydro-Québec’s acquisition of Great River Hydro for $2.25 billion through its subsidiary HQI US Holding

Shell Petroleum’s acquisition of RNG producer Nature Energy Biogas for S2 Billion

Global Infrastructure Management and Actis acquisition of Latin American renewables company Atlas Renewable Energy for $2 billion

Shell Petroleum’s acquisition of Indian renewables energy developer Sprng Energy Private for $1.55 billion through its Shell Overseas Investments subsidiary

JP Morgan’s 60% in stake in Italian renewable energy company Falck Renewables for $1,4 Billion through The Infrastructure Investments Fund (IIF),

Africa Finance Corporation and Infinity Group’s acquisition of Lekela Power for $1.5 billion

Toyota Tsusho Corporation 40% stake in Eurus Energy Holdings Corporation for $1.38 billion

NextEra Energy purchase of a portfolio of operating landfill gas-to-electric facilities from Energy Power Partners Fund and North American Sustainable Energy Fund for $1.13 billion

JSW Neo Energy acquisition of 1,753 MW of Renewable Energy Portfolio from private Indian company Mytrah Energy for $1.28 billion

Brookfield Renewable’s acquisition of Scout Clean Energy for $1 billion

African M&A Activity

Although there is some uncertainty due to increasing cost of capital, the Russia–Ukraine conflict, and market volatility. The world will continue to add as much renewable energy capacity in the next five years as it did over the last two decades with the International Energy Agency expecting 2,400 GW of renewables to come online through 2027. Africa’s contribution to this increased capacity is expected to accelerate, driven heavily by South Africa through both government and private funded initiatives and projects. For example –

• The US, the UK, France, Germany, and the European Union have committed $8,5 billion to help South Africa finance a quicker transition from coal as the world’s 12th biggest emitter of climate warming gases and heavily reliant on ageing coal-fired power stations for its electricity, providing a model for other countries.

• South Africa renewable energy developer Red Rocket has raised R3 billion ($160 million) in funding for renewable energy expansion and addressing South Africa’s electricity demand challenges.

• South African Banks, Standard Bank and Nedbank, have arranged R5.7 billion ($297 million) and R2 billion ($105 million) worth of sustainable financing deals in the first six months of 2023 respectively. Accounting for a combined 20% of the total value on the continent, eclipsing international institutions like Bank Of America, Bank of China, and Barclays.

The involvement of prominent investors reflects a growing confidence in African renewable energy projects, acting as a catalyst for more M&A activity on the continent. With this market evolution comes the opportunity for significant M&A activity albeit with a shifting transaction profile. Indications are for deal flow to remain strong as developers look to monetize opportunities and benefits driven by favourable legislation. While incentives have provided unprecedented financial certainty for developers and investors in the long term, it has caused some short-term delays that contributed to the drop in installations. These new incentives required many developers to pause and evaluate their impacts on project economics, including reassessing project pricing and valuations for in-progress transactions. We expect to see an uptick in installations for the remainder of this year as these delayed projects come online and additional guidance is released

Trends Driving M&A Activity

Increased Industry Consolidation and Portfolio Management

With numerous reports of major utility companies selling or preparing to sell portfolios of renewable energy assets, we expect that we will see an increase in the number of for-sale projects as developers look to recycle and replenish capital. Conditions for the remainder of 2023 and into the first half of 2024 are primed for an upswing in M&A activity propelled by a resurgence in industry consolidation and portfolio management as sector incumbents consolidate their positions and new participants seek viable entry points. A strong cost position, accomplished by scale, and the commercial advantages of portfolios diversified across technologies and markets will increasingly serve as competitive differentiators. The advantages of M&A are becoming increasingly imperative. As a result, robust M&A activity appears to be here to stay for the foreseeable future as intense competition in the renewables landscape and the high ambitions of many of these players increase the likelihood that M&A will be necessary to achieve their targets.

Adaptation to Market Challenges and Diversification into Emerging Technologies

With the new renewable energy incentives, investment returns may decline due to market saturation, and utility planners will want to provide their investors with certainty and predictability. Creative solutions and investor flexibility will be required as persistent supply-chain issues, long interconnection queues and high inflation remain. Furthermore, the rising interest rate environment will likely cause downward pricing pressure on 2023 asset sales and valuations. To address these challenges, we expect renewable energy investors to seek deals at the right price and move towards emerging technologies and subsectors to achieve an acceptable risk-adjusted rate of return. Furthermore, competitors may more closely examine the divestiture of non-core assets as a path to free up cash flow for strategic acquisitions or other operational drivers. Companies that aim to capture the most deal value in this new landscape must implement strong and disciplined processes to remain competitive. As competition rises, acquirers must become more disciplined to capture value from renewables targets by aligning with long-term strategy, enhancing due diligence, and ensuring business continuity. Consisting of many smaller private players, a proactive approach toward outside-in target screening and sourcing on a market-by-market basis can pay off handsomely with advantaged access to favourable transactions. Proactively engaging with targets will enhance the likelihood of being able to access them earlier and will aid in building trust-based relationships that provide a differentiator in competitive negotiations.

In-Depth Due Diligence and Local Expertise

Comprehensive and bottom-up, target screening should assess the strategic fit with the acquirer (i.e., value capture potential including synergies) and the state of the pipeline and portfolio of operational assets for onshore wind, offshore wind, and solar projects. Major challenges for the valuation of portfolio assets typically include the valuation of tail production and the assessment of operational and political risks. Acquirers need to develop a perspective on potential future renewables penetration and corresponding capture prices in core markets, obtain insights on asset valuations in similar regions, and assess potential and prevailing risks with local experts. A strong local market knowledge is vital to assess the target’s intrinsic strengths development capabilities and to establish a view of the track record and capabilities of the target. Therefore, the acquirer’s local development teams should play a strong contributing role to the M&A function in performing the sourcing and screening.