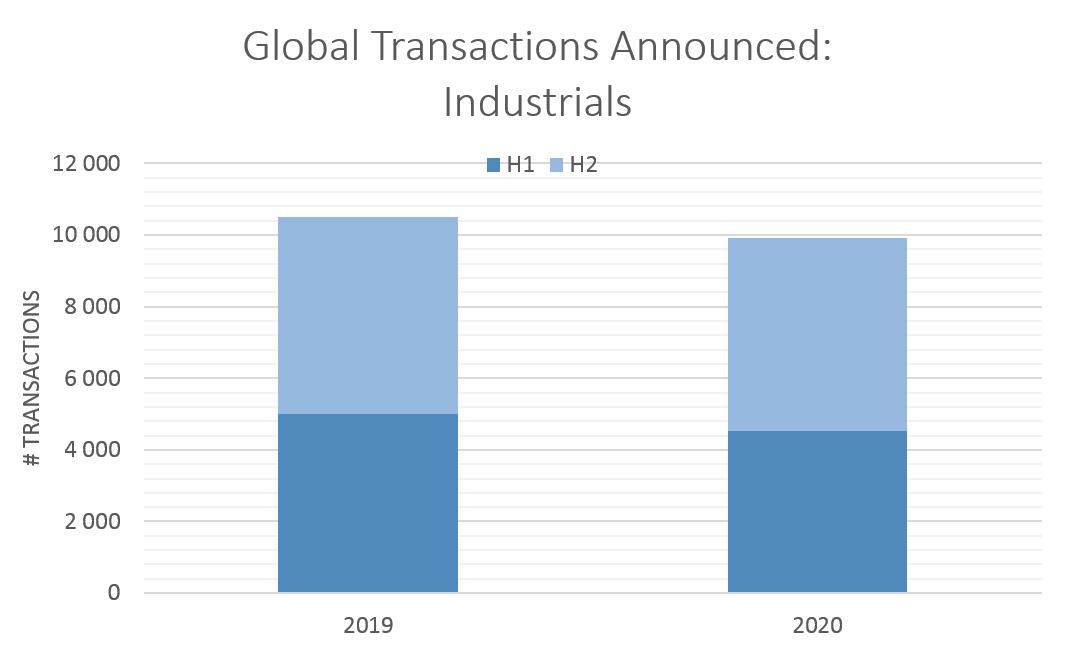

Even with the pandemic, global M&A activity in the industrial sector during 2020 only decreased by 5% compared to 2019 levels. Most of this activity took place during the latter end of the second half of the year, as lock-down restrictions were eased.

Most industries were forced to implement various coping mechanisms in order to adapt with the change presented by COVID-19. Many organisations implemented remote working policies, however these policies were more difficult to implement within the industrial sector.

The increased H2 M&A activity was largely driven by transactions that were originally placed on hold during H1 allowing businesses to evaluate the implications of COVID-19 in terms of transactions. However, new M&A activity also became evident from Q3, as buyers started to see opportunities and re-enter the market.

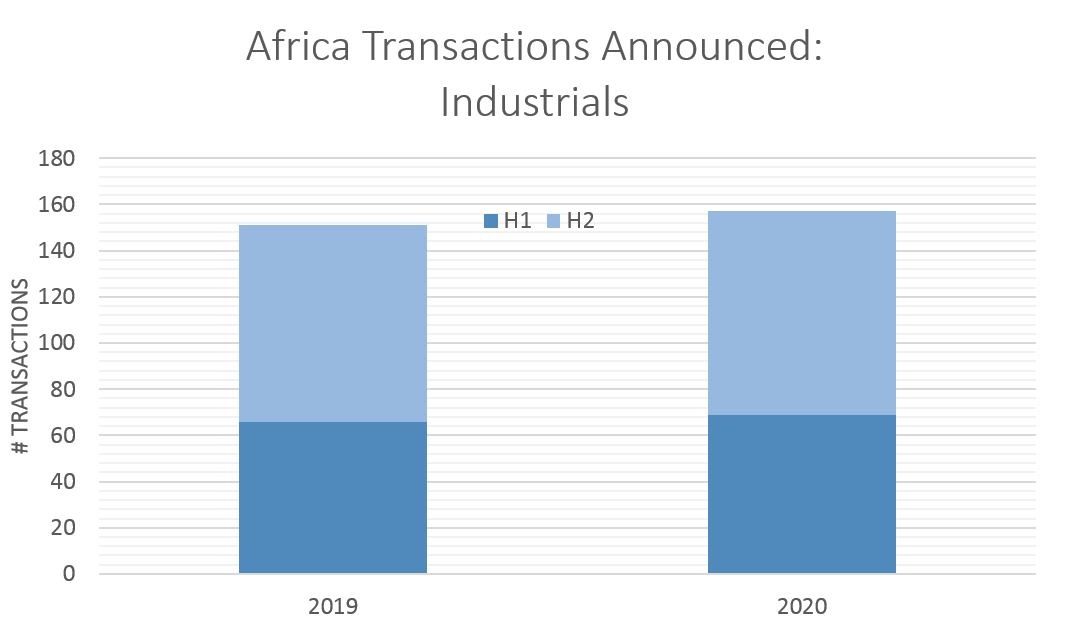

While Africa as a continent showed relatively stable activity in the industrial sector for the year, transactions announced in South Africa decreased by 38% during H1 2020 compared to H1 2019, with activity in H2 not able to make the decrease as activity matched that of the previous corresponding period, as can be seen below.

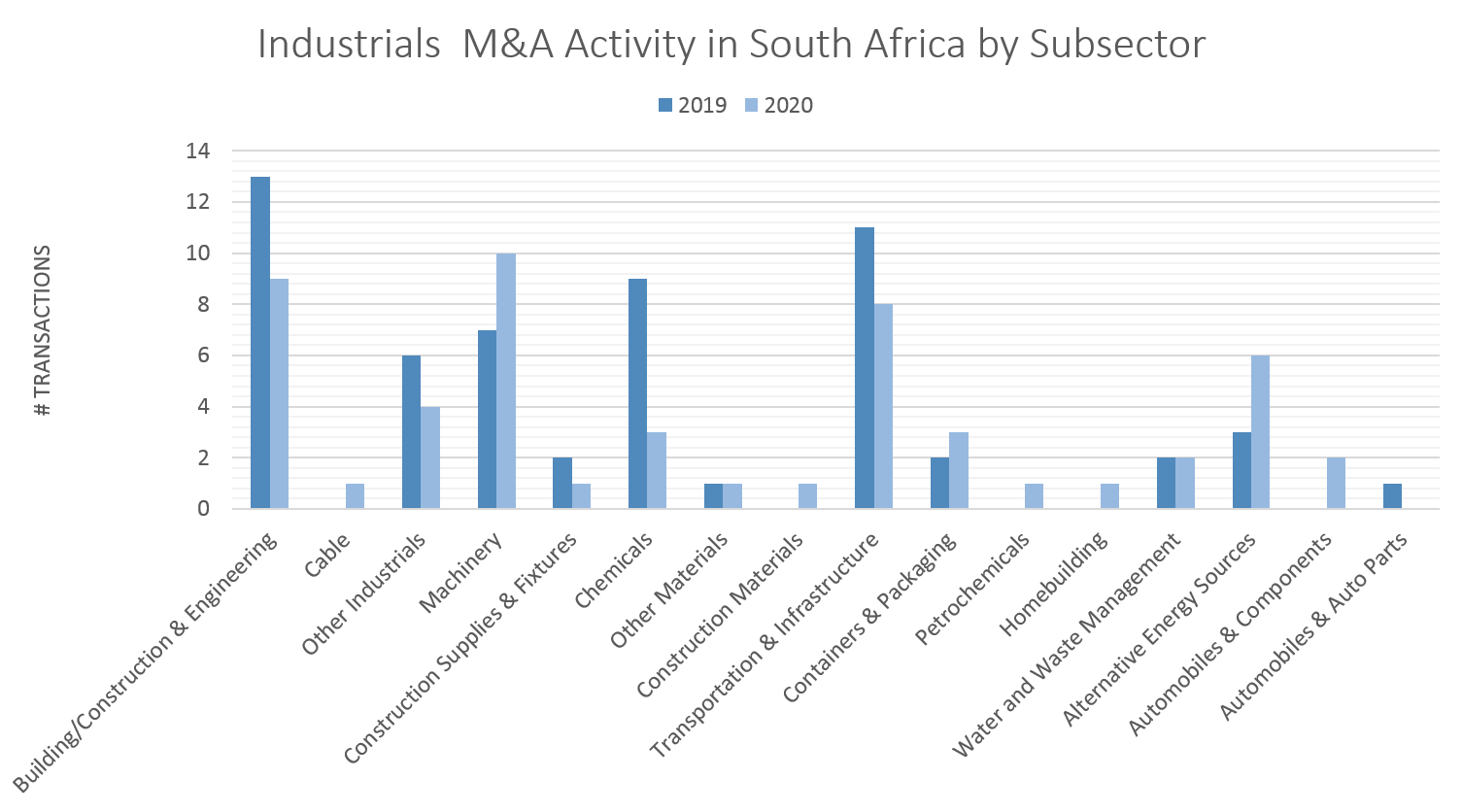

In-terms of M&A trends in the South African market during 2020, building/construction & engineering, machinery, transportation & infrastructure and alternative energy sources were the key drivers of M&A activity.

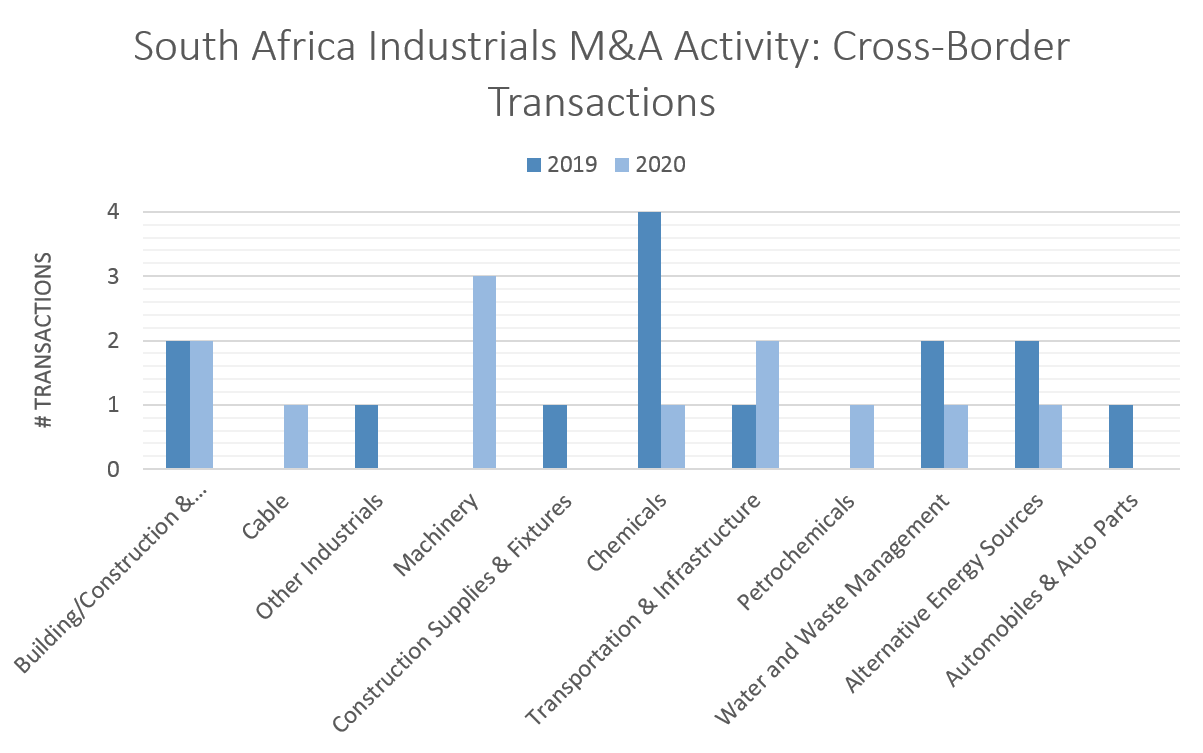

Contrary to the above, one of our key indicators for an active market, being cross-border activity, remained stable in South Africa during 2020. Most industrial sub-sectors withheld their cross-border transaction levels compared to 2019, with machinery and transportation & infrastructure producing significant growth during 2020.

Based on these trends, 2021 M&A activity in the South African industrials sector is expected to show a significant increase compared to 2020, primarily driven by global trends in the sector and an increase in spend on infrastructure, energy and related services. This with the local buyers beginning with market consolidation initiatives could make the industrials sector one to keep an eye on in 2021.

Merchantec Capital’s network of both local and international buyers places us in the best position to guide you through partially or fully exiting your business during this opportune window.