Industry Outlook

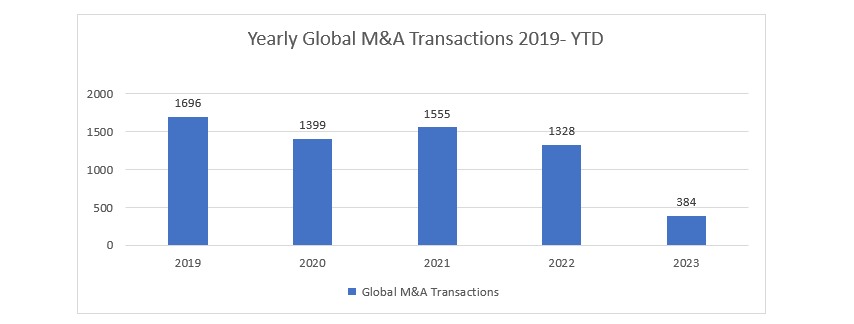

In reference to the below illustration of the recent publicly known global M&A Activity within the overall Food and Beverage industry. Despite the combined constraints of trade sanctions, disruption to global supply chains, avian and swine flu outbreaks, the ongoing conflict in Ukraine, volatile equity valuations for public companies, and overall market uncertainty contributing to the sustained hesitancy among strategic and financial buyers. Global M&A activity has remained resilient within the food and beverage sector, although retreating to more sustainable levels in 2022.

.

Since the highs of 2021, where we saw an increase of 11.05% in transaction volume, and an increase of 42.92% increase in aggregate transaction value from 2020. Global M&A activity in the Food and Beverages industry has cooled closer to 2020 numbers in terms of transaction volume and value. Decreasing by 13.95% in the number of transactions completed and 36.09% in aggregate value of transactions from 2021. Although H2 2022 improved across both the total number of transactions and aggregate deal value, the downward trend in activity in 2022 has persisted through to 2023.

Demonstrating both the defensive nature and diversification-focused mindset within the sector, where growth by acquisition is often faster, less costly, and more predictable than organic growth. M&A activity in 2022 was driven primarily by the continued consolidation of strong and growing brands by strategic buyers acquiring their competitors to expand their market share. For acquirers, purchasing an already consumer-tested brand provides a pathway to immediately gaining a foothold into a new category or strengthening their existing presence. Packaged Foods and Meats Producers (53%), beverages (18%), and food retail (16%), accounting for most of the activity

Notable Transactions Include

Ica-Handlarnas FÖRbund Ab and AMF Pensionsförsäkring AB acquisition of ICA Gruppen for $ 5.75Bn

Doordash Expands Delivery Capabilities with $8.1Bn Acquisition of Wolt

Wayne Farms Acquires Sanderson Farms for $4.4Bn

PAI Partners’ $3.5Bn Acquisition of Tropicana and Other Juice Brands

Mondelēz International to Acquire Clif Bar & Company for at Least $2.9Bn

CVC Capital Partners Acquires Ekaterra BV from Unilever for $5.09Bn, Entering the Tea Production Sector

With more consumers looking for discounted and differentiated alternatives in face of rising cost of living pressures. Private label food manufacturers and processors should continue to see an uptick, and it is anticipated that the industry will experience further consolidation by strategic buyers specifically in the branded packaged goods and beverage sectors in 2023 as acquirers have shifted efforts toward boosting sales volumes and maintaining normalized, sustainable margin levels.

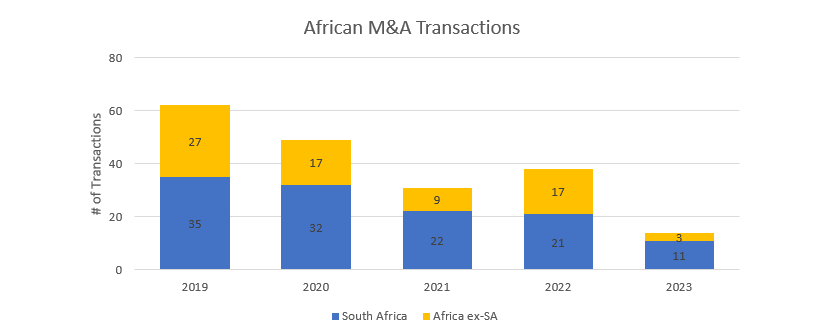

Africa

In reference to the above illustration of the recent publicly known African and South African M&A Activity within the overall Food and Beverage industry. African M&A activity within the food and beverage industry is more dislocated from global M&A activity trends. Africa has distinguished itself from the rest of the world with an impressive surge in activity. Between 2021 and 2022, the number of deals and Aggregate transaction value increased by 22.58% and 69.3% respectively, surpassing trends observed in other regions.

This considerable rise is indicative of a shift towards larger and more valuable transactions during this period, underscoring the increasing importance and attractiveness of the African market for investors, both from within the continent and globally. It suggests that investors recognize the region’s untapped potential

Notable Transactions Include

Castel Frères, acquisition of Guinness Cameroon from Diageo for $463.72M.

Diageo Kenya’s minority stake acquisition in East African Breweries for a reported $182.M

Namibia Breweries Limited acquisition of Distell Namibia Limited for $91M.

In the first half of 2023, a deceleration in M&A activity is anticipated as rising interest rates influence borrowing costs and dampen the pace of deal-making. The increased cost of capital is likely to prompt a more cautious approach among investors, leading to a potential moderation in deal activity. However, despite this prevailing economic challenge, it is expected that some M&A transactions will still materialize as investors recognize the immense growth potential and opportunities within the African market. The region’s growing consumer base, expanding middle-class population, and evolving consumer preferences continue to attract interest, driving investors to seek strategic alliances and acquisitions to diversify their portfolios and tap into the thriving and dynamic African food and beverage sector.

South Africa

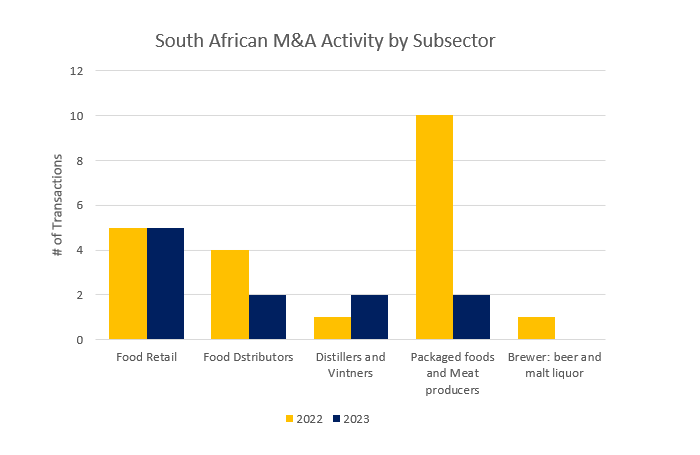

Declining year on year, South African M&A activity within the food and beverage industry has not mirrored either the emerging African or Global trajectory in terms of activity. . Having experienced significant consolidation in the recent past in the Packaged Foods industry, such as Nurture Foods Investments 40% purchase of Fairview Cheese Company. The dislocation can be primarily attributed to the unfavourbale and deteriorating operating conditions facing competitors within the South African landscape with declining consumer and business confidence, crumbling municipal infrastructure, unreliable energy source, increase in animal disease outbreaks, political instability with the ruling party, rising interests, unskilled workforce, rampant unemployment, and social unrest.

In recent years, the Packed Foods and meat producers industry in South Africa has experienced significant consolidation, representing 48% of total transactions in 2022. However, the sector is poised to face challenges in H1 2023 due to rising interest rates and political uncertainty. Despite this anticipated slowdown, a resurgence in M&A activity is expected as companies seek to unlock shareholder value and expand market share. Sekunjalo Investments has already taken a proactive step by announcing plans to acquire minority shares in Premier Fishing and Brands, with the intention to delist from the Johannesburg Stock Exchange (JSE), signaling a trend towards strategic moves to optimize market position and capitalizing on future opportunities in the industry.

The food retail space in South Africa is expected to witness increased deal activity as executives navigate rising costs and aim to maintain profit margins. To achieve this, businesses are streamlining operations and divesting non-core assets. A recent example of this trend is RCL Foods’ announcement to sell Vector Logistics to Danish fund manager AP Moller Capital. This strategic move reflects the industry’s focus on optimizing their core businesses and capitalizing on opportunities to bolster profitability while adapting to market challenges.

Notable South African transactions

Shoprite holdings has acquired the non-core food assets of Massmart for $89.74M

PSG Group Ltd spin off of Kaap Agri Limited for $79.12M

Silver Blade Abattoir (Pty) Ltd a subsidiary of Country Bird, purchasing of a meat processing plant for $17.91M, from Tiger Brands

From a South African lens, load shedding has continued to be a huge obstacle for businesses in the food and beverage sector from increased pressure on margins from the monumental surge in their diesel costs to the increased wastage from compromised cold chains, impacted irrigation, and stymied slaughtering schedules. As larger companies such as Nestle, SAB and RFG amongst others, invest in alternative renewable power solutions to insulate their operations from load shedding disruptions. Although we anticipate both transaction volumes and aggregate transaction values to continue to be constrained from a cross border perspective as acquirers wait for further clarity regarding South Africa’s non-aligned positing on the Russian Ukraine conflict. We expect to see continued consolidation of local competitors as companies rebalance and reposition their portfolios by divesting from non-core and high-carbon assets to put returns towards core business and future growth. Such as Tiger Brands confirms plan to sell the troubled loss-making Langeberg and Ashton Foods (L&AF) deciduous fruit canning plant in the Western Cape.