Higher levels of global trade & increased profits have led to an increase in M&A activity during 2021 & the first half of 2022.

The health of the global logistics sector is very closely linked to the performance of global trade. Although global trade fell sharply during the second quarter of 2020, it has increased every quarter since, making record highs in the process. This has subsequently led to increased logistics sector profits with the clearing and forwarding industry benefiting in the process.

The ongoing war in Ukraine has however put a damper on global trade since it erupted in February, severely disrupting shipping and air freight in the region and adding to ongoing supply chain pressures. Increased port congestion, longer transit times, and higher freight fees have become standard for companies shipping to and from the warring countries. Although the effects of the war in respect to this industry can be felt globally, the bulk of it is confined to the region.

As a result global trade volumes are still expected to increase by 3% in 2022 and 3,4% in 2023. The clearing and forwarding industry is set to experience modest growth over the coming years. Realised growth will most likely be higher as a result of efficiencies unlocked through the adoption of new technologies.

Some of the most notable deals coming out of the international clearing and forwarding landscape include Deutsche Post DHL Group’s acquisition of J.F. Hillebrand for €1,5 billion in March and AP Moller – Maersk’s acquisition of global air freight forwarding company Senator International for $644 million in June 2022.

M&A activity on the African continent

The African clearing and forwarding landscape is highly fragmented with multinational companies holding a majority of the market share.

Historically, the industry experienced low growth rates as a lack of transport infrastructure (roads, ports, airports) led to higher transport costs, subsequently cutting into freight forwarding margins. Today, the industry is seeing higher than average growth as the implementation of new technologies help unlock efficiencies that were previously unavailable.

The industry’s growth prospects is further bolstered by the African Continental Free Trade Area (AfCFTA) that came into force in January of 2021. The agreement is expected to boost intra-Africa trade by eliminating trade barriers and reducing costs.

Clearing and forwarding industry

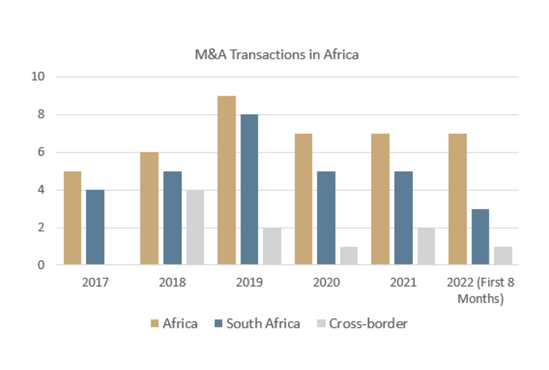

7 M&A transactions were announced in Africa during the first 8 months of 2022, which is equal to the full year of 2021, setting 2022 up for a 5 year high.

Cross border M&A transactions

Over 57% of the transactions announced since 2021 have been cross-border transactions. The most notable transactions include:

– DP World (March 2022)

-MSC (April 2022)

-Integrated Service Solutions (May 2021)

M&A activity in South Africa

The South African landscape is highly fragmented and becoming increasingly competitive due to the presence of both local and multinational clearing and forwarders.

However, since the start of the COVID-19 pandemic, the industry benefited significantly from higher global demand for goods. This led to increased profits, making the landscape more attractive to both domestic and international acquirers.

In addition to the above, the South African government, via the Transnet National Ports Authority (TNPA) has pledged to invest R25 billion toward developing the country’s national ports over the next 7 years with at least R450 million to be invested during 2022. This investment will stimulate ocean freight and reduce transport costs adding to the industry’s attractiveness.

Factors driving M&A activity

Diversification of products/services

In an attempt to weather uncertainty, freight forwarders and logistic service providers, are looking to M&A to expand their service offering. AP Moller – Maersk, an ocean freight forwarder, acquired global air freight forwarding company Senator International in June of 2022. The acquisition provides AP Moller – Maersk with air freight forwarding capabilities which will help stabilise the company’s revenues as global port congestion intensifies.

Geographic expansion .

The African clearing and forwarding industry is becoming increasingly attractive to multinationals who are looking at entering and strengthening their positions in Africa. As multinationals look to acquisitions to capture market share.

Private equity involvement

Over the past 2 years 36% of transactions announced in Africa involved private equity. There are various factors that contributed to this attraction pointing towards:

-The industry’s growth prospects;

-The industry is highly, creating opportunities for consolidation and buy-and-build acquisition strategies; and

-The relative asset-lightness of the industry.