The South African Food & Beverage industry continues to be dominated by strategic buyers which accounted for approximately 87% of all completed transactions year-to-date.

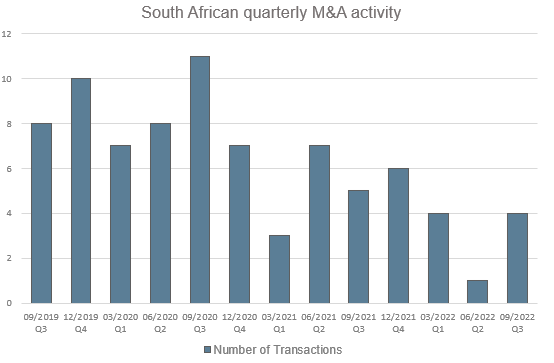

The South African Food & Beverage industry has historically provided a stable environment for M&A activity. This has somewhat changed in recent years with deal activity in 2021 and the first half of 2022 significantly lower than the years before.

Year-to-date we’ve seen the industry plagued by rising fuel costs, supply chain difficulties, and higher inflation leading to the erosion of profit margins. Companies have had to adapt to this changing environment by increasing their efforts to reduce costs and improve efficiencies. There is however a silver lining.

M&A activity in the food & beverage industry

M&A appetite in the Food & Beverage industry is expected to remain strong. The activities believed to drive this recovery through the second half of 2022 into 2023 include:

South Africa's M&A transactions in the food and beverage industry (2017- 2022YTD)

Recent acquisitions and industry trends

Packaged food & meat producers

Description: On 31 December 2021, South African manufacturer and supplier of consumer-packaged goods, Libstar Holdings, acquired South African manufacturer of frozen ready meals, Umatie.

Rationale: Major producers are expected to take control of their distribution channels via vertical integration acquisitions/mergers, and the increased consumer health-consciousness is expected to drive the acquisition of health-related food brands. The increased focus on consumer convenience will drive transactions in the direct-to-consumer, frozen foods, and ready-made goods space.

Distillers & vintners and brewers

Description: On 1 July 2022, South African private equity firm, RMB Corvest, acquired Halewood International, a South African manufacturer of malt beverages with brands including Belgravia Gin, Red Square Drinks, Buffelsfontein Brandewyn, and more.

Rationale: A rise in demand for craft beers will fuel acquisitions of notable brands with an existing loyal customer base.

Description: On 6 July 2022, Spanish sparkling wines producer, Freixenet, acquired Spier Wines, a South African vintner. On 15 November 2021, Netherlands-based brewer, Heineken, announced their intention to acquire control of South African brewing and beverage company, Distell.

Rationale: Portfolio consolidation and geographic expansion acquisitions are expected to continue within the liquor industry.

Food distributors

Description: On 9 February 2022, US logistics company Archer-Daniels-Midland acquired South African distributor of chemicals and food ingredients, Comhan Products.

Rationale: Distribution challenges are expected to drive acquisitions as producers are looking toward vertical integration to defend and increase margins.

Description: On 13 December 2021, Shoprite Checkers entered a joint venture with logistics company, RTT Group, that will result in the retailer owning a 50% stake in the online delivery company Checkers Sixty60.

Rationale: Increased focus on consumer convenience by moving towards e-commerce platforms and related services such as last-mile delivery are expected to persist throughout 2022.

Food retail

Description: On 25 August 2021, South African retailer Massmart announced their intent to acquired OneCart, a FMCG marketplace and logistics platform.

Rationale: Traditional brick-and-mortar food retailers will look to regain lost market share via acquisitions of (or) partnerships with online retail platforms.

Soft drinks

Description: On 11 May 2021, Coca-Cola Beverages Africa alongside an investment consortium acquired the soft drinks division of Maluti Mountain Breweries.

Rationale: A growing consumer demand for healthier, lower sugar alternatives and functional drinks is expected to drive development and acquisitions.

Strategic M&A activity in S.A

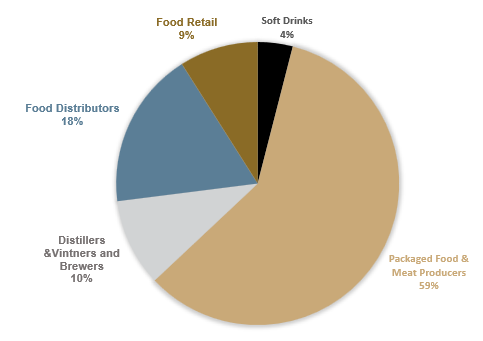

Customers are drawn to food products whose packaging reflects their lifestyle, dietary preferences, and portability. The bulk of transactions in the graph below demonstrate how packaged goods have evolved into a crucial link in the modern food value chain. Due to the pandemic lockdown and people’s dread of leaving their homes, 2020 had the most M&A transactions.

Industry breakdown by M&A transactions in S.A. 2017-2022YTD

Strategic M&A activity in S.A quarterly