Current M&A activity announced during 2021 shows signs of a bullish year in the FMCG sector. With the key themes expected to dominate FMCG M&A activity during 2021.

In this article we compare FMCG activity in the last two years which reflects an upward trend going into 2021 and 2022

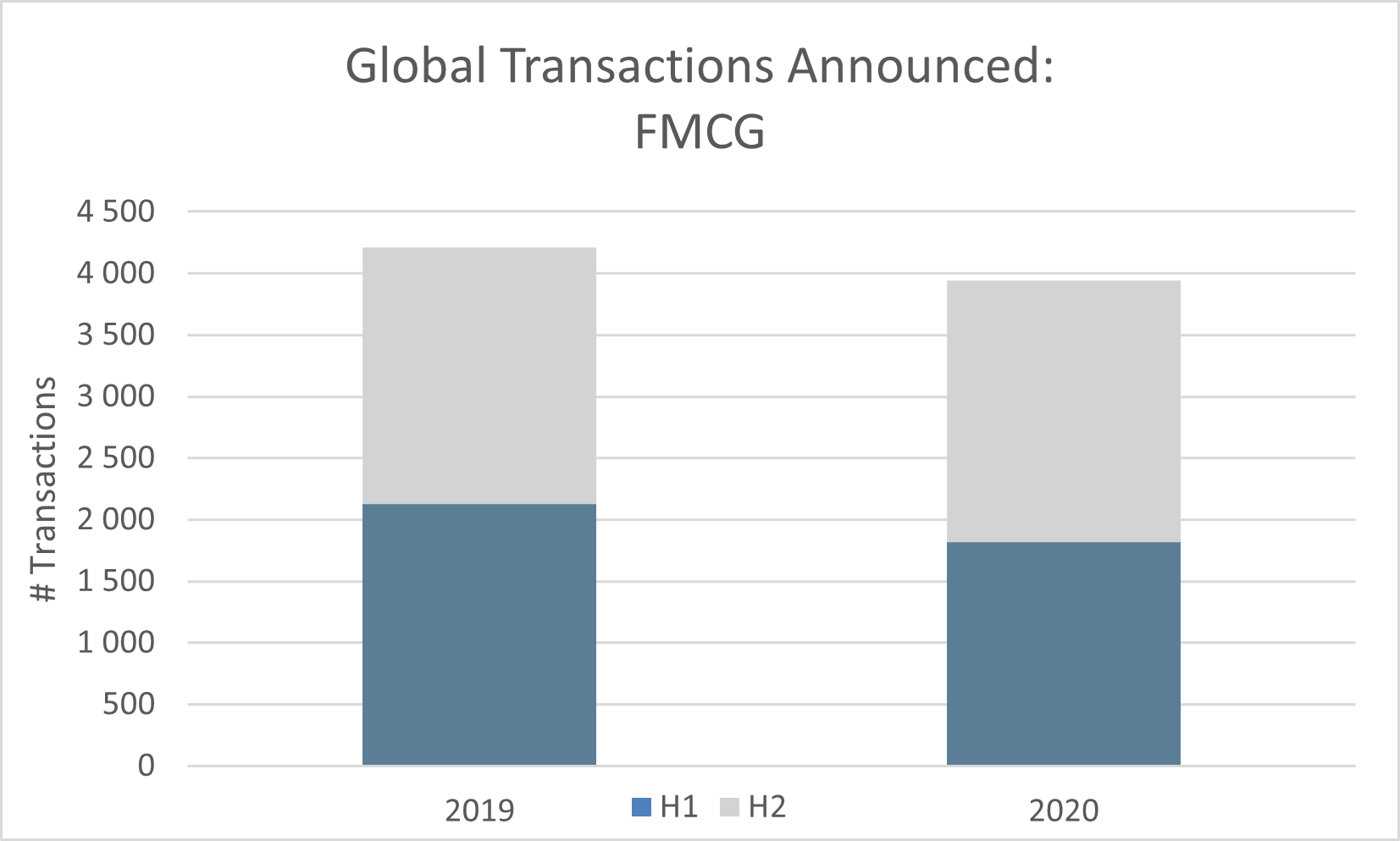

Global M&A activity in the FMCG sector during 2020 fell short of 2019 levels by 6%, which was attributable to the hard lockdowns experienced during this period. As lockdown restrictions were relaxed during the second half of 2020 M&A activity in the FMCG sector increased again with the H2 2020 M&A transactions exceeding H2 2019 levels.

- FMCG organisations are looking to expand their consumer reach by moving towards e-commerce platforms and related services, such as last-mile delivery.

- A global drive involving ethical consumerism will show an uptick in M&A activity with brands that minimises environmental damage.

- Businesses that are looking for growth by way of corporate consolidations and strengthening of balance sheets through direct investment.

The increased H2 M&A activity was largely driven by transactions that were originally placed on hold during H1 allowing businesses to evaluate the implications of COVID-19. However, new M&A activity also became evident from Q3, as buyers started to re-enter the market.

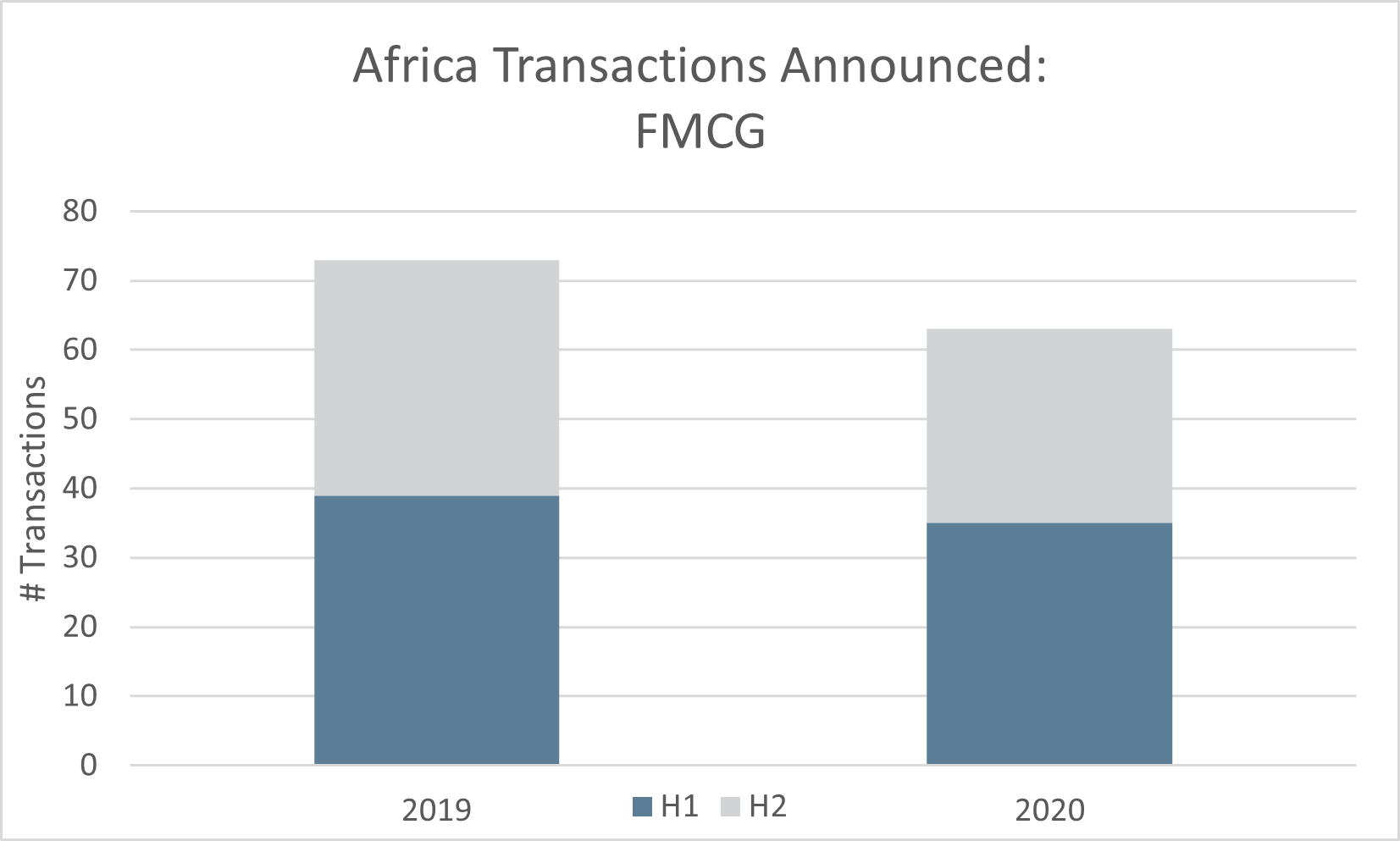

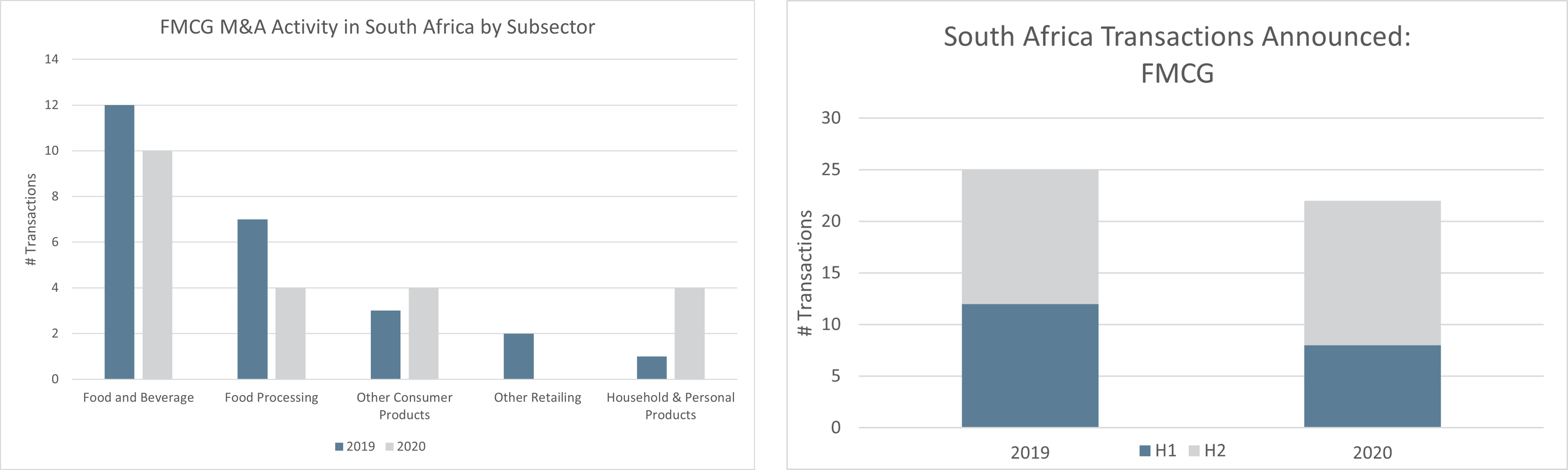

Africa as a continent showed an overall decline of 14% in M&A activity during 2020 with both H1 and H2 of 2020 showing decreased transaction activity during the year. South Africa was particularly affected during H1 2020, however, H2 2020 showed an improvement of 8% compared to H2 2019.

Notable transactions that took place during 2020:

- The acquisition of Plush Professional Leather Care (Pty) Ltd by Adcock Ingram Ltd

- The acquisition of Tongaat Hulett Starch (Pty) Ltd by KLL Group (Pty) Ltd

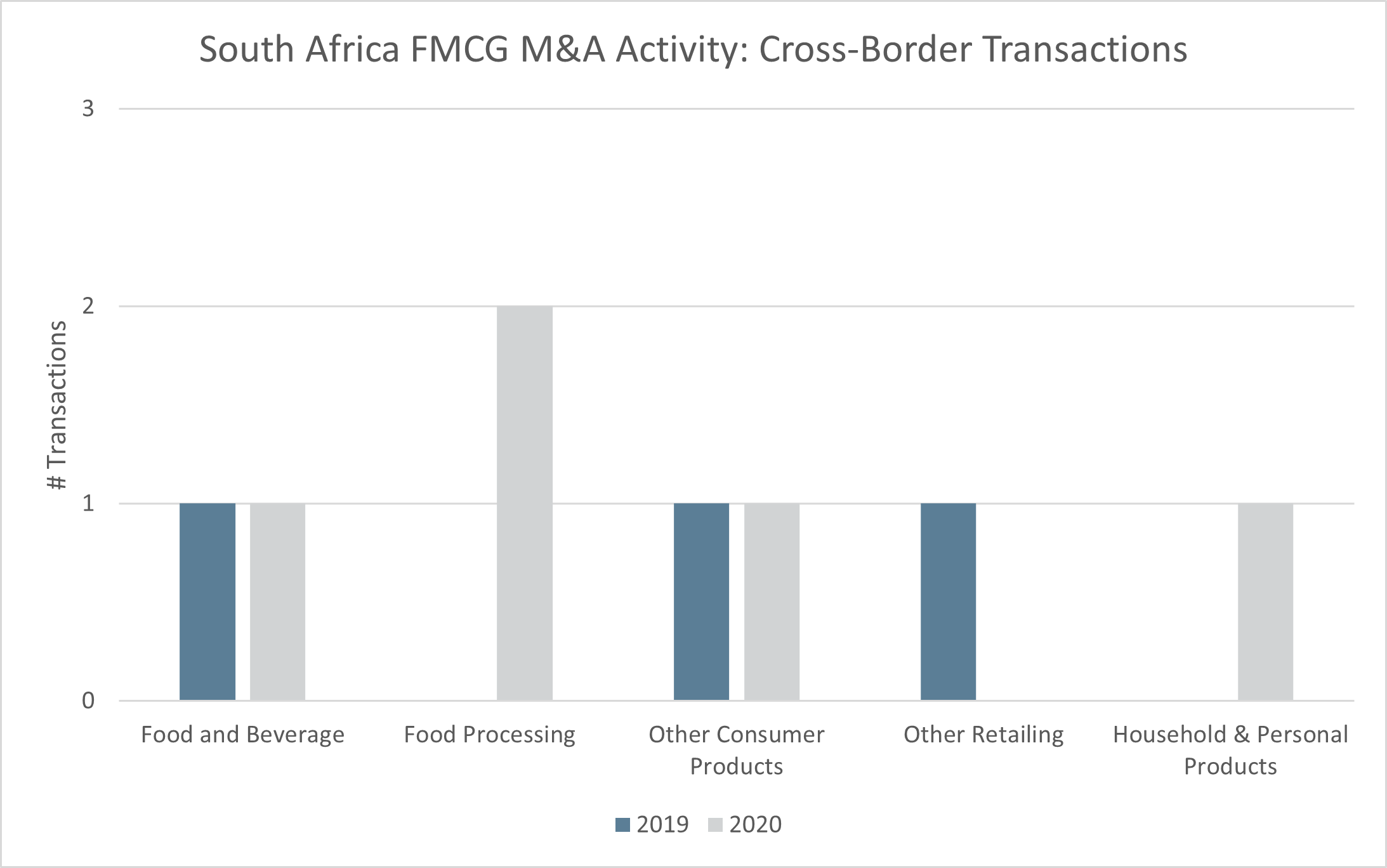

South African cross-border M&A activity showed overall improvement during 2020, with food processing and household & personal products leading the front on cross-border activity compared to 2019.