Global Sector Outlook

The African Financial Services sector proved to be more resilient compared to the rest of the world.

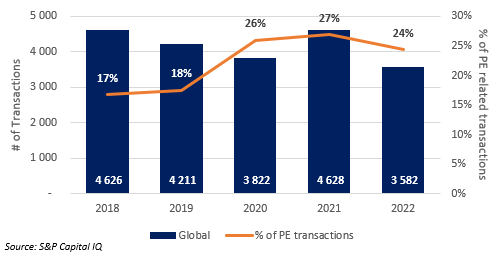

M&A activity in the global financial services sector has been trending lower over the past 5 years. 2021 provided the industry with some respite, breaking the downward trend and reaching new 5-year activity highs. This was however short lived as turmoil in the financial markets relating to the outbreak of the new Omicron variant and inflation fears forced investors to be cautious and remain on the side-lines. As a result, deal activity in the first half of 2022 ended 25% lower than H2 of 2021. With transaction activity declining even further in the second half of the year, deal activity for 2022 closed 23% lower than the year before.

Although deal activity was lower during 2022, it is expected to rebound in 2023 as many transactions that were put on hold last year, are expected to close in the next 12 months. Another positive factor to consider is the involvement of private equity’s (“PE”) in the sector. The investor group was active during 2022, accounting for approximately 24% of all completed transactions during the year with similar activity levels expected throughout 2023.

2022 was a good year for financial services mega-deals (transactions with values above R10 billion). The year saw a total of 152 mega-deals completed, amounting to over R7.4 trillion with the bulk of transactions occurring in the USA (79), the UK (11), Hong Kong (4), and Australia (4). Standard Bank Group’s acquisition of the remaining 43% stake in Liberty Holdings during February for R11.8 billion was South Africa’s sole mega-deal during the period.

Global M&A transactions

Notable global M&A deals

S&P Global’s acquisition of IHS Markit during February for $49,4 billion.

Berkshire Hathaway’s acquisition of Alleghany Corporation during October for $11.6 billion.

Block Inc’s acquisition of Afterpay Limited through its subsidiary, Lanai Limited during January for $11.8 billion.

Thomas Bravo’s acquisition of Bottomline Technologies for $2.6 billion.

M&A activity in the African Landscape with a focus on South Africa

African M&A transactions

South African M&A transactions by sub-sector

The African Financial Services sector proved more resilient compared to the rest of the world. While global M&A activity declined by 23% between 2021 and 2022, African deal activity increased by 13% over the same period. Fintech and Wealth & Asset Management were relatively strong, fuelling the sector’s activity growth – collectively accounting for 52% of total deals concluded in Africa and 70% of total deals concluded in South Africa during 2022.

In South Africa, Fintech, is the largest sub-sector by deal volume, accounted for 37% of completed transactions during 2022. Eleven Fintech transactions were completed during the year, representing a 266% increase Y-o-Y (2022: 11 vs. 2021: 3). Wealth & Asset Management came in a close second, accounting for 33% of completed transactions, with 10 deals concluded during the period, representing a 43% increase from the year before.

Cross-border transactions increased by 20% during 2022, largely driven by an increase in Fintech related cross-border transactions. Given the rapid rise of the Fintech sub-sector over the past decade, the attractiveness of African Fintech assets to foreign investors, and South Africa being the preferred gateway into Africa, we expect this trend to continue throughout the near future.

Notable South African M&A transactions

Standard Bank’s acquisition of the remaining 43% stake in Liberty Holdings during February for R11,8 billion, expanding their ecosystem and scaling their insurance and asset management businesses.

Old Mutual Private Equity’s (“OMPE”) acquisition of Long4Life Limited during May for R4,2 billion, providing shareholders with a clean exit and enabling OMPE to unlock latent value in the underlying portfolio.

Net1 Applied Technologies’ acquisition of Cash Connect during April for R3,9 billion, strengthening Net1’s footprint in the South African Fintech market.

African Bank Limited’s acquisition of Grindrod Bank during November for R1,5 billion, expanding the bank’s business banking division.

Key themes driving M&A activity in South Africa

In a competitive environment of rising cost pressures, where rapid action and response is necessary, financial institutions need to modernize their technology function to support expanded digitization of both the front and back ends of their businesses.

We therefore expect M&A, partnerships, and strategic alliances during 2023 to focus on capability-driven deals to drive operational efficiencies, implement new solutions, and address rising cybersecurity concerns.

Firms operating in the financial services sector tend to utilise highly scalable infrastructure that introduce considerable operating leverage into their cost structures, improving profitability as revenues increase. Firms looking to improve profitability are therefore expected to turn to acquisitions to increase revenues.

Given the fragmented nature of the industry, and the abundance of opportunities within, we expected the industry to continue consolidating throughout 2023 as investors look to gain size to unlock value.

Private equity accounted for approximately 25% of all completed transactions in South Africa between 2021 and 2022. While this trend is expected to continue into 2023, the industry is likely to gain attention from international private equity as well, given the stark contrast between domestic and international M&A performance.

M&A trends in the South African financial services

Banking & Capital Markets

-The Banking & Capital Markets industry is rapidly shifting toward digital solutions. Brick-and-mortar banks are therefore increasing investment into fintech and disruptive technologies to gain access to predominantly scalable, client-centric tech capabilities while protecting market share.

-This trend is further strengthened by an increase in the number of bank branch closures as banks look to transition into the digital space in an attempt to reduce costs.

-Banks are increasingly being pressured to exit business lines where they do not have a competitive advantage.

Insurance

-Ongoing brokerage consolidation is expected to continue as firms look to unlock scale economies.

-There is increasing pressure on insurance companies to either acquire or form strategic partnerships with insurance technology competitors to protect market share.

-Insurance brokerage firms are coming under increased pressure from legislation to meet B-BBEE requirements. We expect this to play a role in transactions going forward.

Wealth & Asset Management

-The market remains highly fragmented and further consolidation is likely, especially for large asset managers who face margin compression and are motivated by cost-cutting and scale economies.

-Wealth management companies are evolving from single-product to multidisciplinary models allowing clients to invest in various asset classes without investing across multiple firms.

-Firms are therefore turning to investing in smaller strategic partners to help fill gaps in their product offerings and key capabilities.

Fintech

-M&A activity has rapidly increased in the payments and specialty finance areas.

-Market consolidation is expected to continue as fintechs look to build platform businesses aimed at unlocking cross-selling opportunities.

South African Financial Services M&A is expected to continue at elevated levels in 2023 – focusing largely on the Fintech and Wealth & Asset Management space. We expect M&A activity during 2023 to continue building on momentum seen during 2022, as demand from both strategic investors (local and international) and private equity firms remain high.