Global Sector Outlook

A tumultuous time might be in store for the global wealth and asset management industry in the year ahead. Higher interest rates coupled with higher inflation is likely to cause a decline in top line growth figures, while investors, at the same time, are becoming increasingly weary.

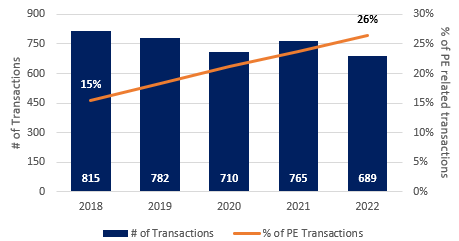

Global M&A activity in the industry reached a new 5 year low in 2022 with 689 transactions concluded, 10% down from the year before (2021: 765). This is in line with the downward trend in activity experienced over the last 5 years. Deal values, however, tell a different story. Average deal values increased from R1,8bn in 2018 to R11,8bn in 2022 with aggregate deal values following suit.

The decline in deal activity over the period can largely be attributed to a decrease in the number of sizeable companies for sale as the market becomes increasingly consolidated. A key driver of this consolidation initiative is the private equity (“PE”) industry which has become increasingly active within wealth and asset management, accounting for 26% of all completed transactions during 2022. The increasing presence of PE transactions within the industry is a sign of strength, indicating increased opportunity in the space.

The year saw a total of 16 mega-deals completed (with values above R10 billion), amounting to over R1.4 trillion. The majority of which occurred in the USA (4) and the UK (3).

Global M&A transactions

Notable deals

EQT AB’s acquisition of private equity firm Baring Private Equity Asia during October for $5.1 billion.

KKR & Co’s acquisition of REIT specialist Joint Venture Mitsubishi Corp.- UBS Realty Inc. during April for $1.8 billion.

Goldman Sachs Asset Management’s acquisition of asset manager, NN Investment Partners, during April for $1.85 billion.

The Carlyle Group’s acquisition of collateralized loan obligation (CLO) funds from CBAM Partners during March for $813 million.

M&A activity on the African continent focusing on South Africa

Although African M&A activity in the wealth and asset management industry improved from 2021 levels, the industry has whipsawed over the last 5 years, from a high in 2018 (31 transactions), to a low in 2021 (8 transactions). Average transaction values over this period have however steadily increased, reaching a new 5 year high in 2022 (R4.3 billion), following suit with the global trend. Additionally, private equity’s involvement on the continent increased over the same period, accounting for 25% of completed transactions in Africa during 2022 (SA: 30%).

African M&A Transactions

Notable South African transaction

PSG Group Ltd.’s spinoff of their wealth management business, PSG Konsult Ltd. during September.

Old Mutual Private Equity’s acquisition and subsequent delisting of the asset management holding company Long4Life Ltd. during May, providing shareholders with a clear exit, and unlocking latent value in the underlying portfolio assets.

Sinayo Capital’s acquisition of a minority stake in asset management firm Kagiso Asset Management during February, backing the management team in a management buy-out.

Stonehage Fleming announced their intention to acquire SA-based investment firm, Rootstock Investment Management, during October for an undisclosed amount, strengthening their position in the South African market.

Trends expected to drive M&A activity in the sector

Industry consolidation

The South African wealth and asset management industry is highly fragmented with a large number of service providers competing for market share. Consolidation within the industry is likely, especially as firms face margin contractions and look to benefit from both scale and scope initiatives.

Diversification of products and service offerings

Wealth management companies are evolving from single- to multi-product models allowing clients to invest in various asset classes without investing across multiple firms or platforms. This creates opportunities for acquisitions and strategic partnerships as wealth managers look to fill the gaps in their product offerings and key capabilities.

Transition to digital solutions

Customers – particularly retail customers – have increasingly demanded improved user experience and lower overall fees – and are willing to change service providers in search of better alternatives. This has created a challenge for legacy firms as tech-enabled challengers systematically eat away at their market share. At the same time, this creates an opportunity for legacy firms to acquire tech capabilities that will help improve efficiency, reduce costs, and give access to previously untapped market segments.

Private equity involvement

The industry has been gaining more and more attention from private equity investors as wealth and asset management provides them with the opportunity to build portfolios of companies with steady cash flows. This trend is expected to continue throughout 2023, fuelling further M&A activity and consolidation within the industry.

Private credit

The private credit industry is expected to benefit from the rising interest rate environment, creating opportunity for traditional asset managers looking to enter the alternatives market. We expect to see an increase in transactions in this space as equity markets experience extreme volatility while firms already in the space look to further expand their capabilities and geographic footprint.

While the mergers and acquisitions environment may look a lot different from previous years, M&A activity in the South African Wealth & Asset Management industry is expected to remain elevated in 2023, even as competition and valuations within the industry subsequently increase. Although the industry still presents investors with significant uncertainty, 2022’s deal activity was noteworthy, and shows no sign of slowing down.