Industry Outlook

In reference to the below illustrations of the recent publicly known global M&A Activity within the Logistics industry from 2018 to H1 2023. Logistics contribution to overall industrial activity has remained consistent from 2018 through to H1 2023. As a sub-sector, logistics contributes on average approximately 13% towards overall Industrial M&A transaction volumes. Mirroring global overall Industrial M&A activity closely, global logistics transaction volumes increased by 5.4% in 2021, largely influenced by the outbreak of the COVID-19 pandemic in 2020 and subsequent reopening of the global economy in 2021. As fears of higher inflation in the latter half of 2021 spilled over into 2022, Global M&A activity in the logistics sector increased marginally in 2022.

The cooling off in activity in global logistics transaction volumes has persisted into 2023 with H1 2023 seeing a 19.5% decrease in transaction volume from H2 2022 and a 12.7% decline when comparing transaction volume of H1 2022 to H1 2023. As global supply chains reconfigure in the face of external headwinds such as the outbreak of the Russian/Ukrainian conflict, the energy transition and rising energy prices, availability of shipping containers, rising geopolitical tensions among trading partners, digital disruption, and increasing cost of capital, Global M&A activity within the logistics sector is anticipated to continue its downward trajectory in line with the global trend in overall industrials industry.

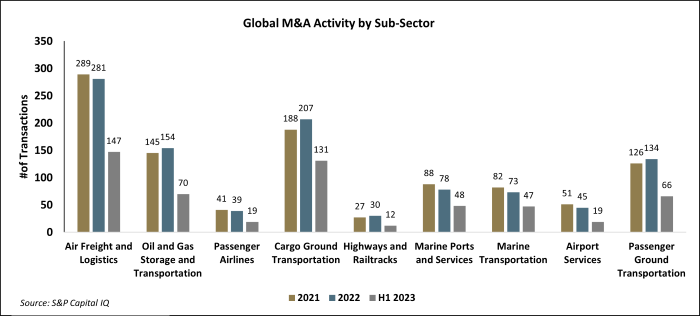

Private Equity’s contribution to M&A transaction activity has remained steady between 14% and 16%, indicating the importance strategic players in driving M&A activity forward. Over the course of 5 years, Europe lead in the number of completed transactions accounting for 40% of total transactions, followed by North America (The US and Canada) accounting for 33% and Asia-Pacific accounting for 19%. The sub-sector contribution to overall logistics activity has remained consistent from 2021 through to H1 2023, with Air Freight and Logistics, Cargo Ground Transportation, and Oil and Gas Storage and Transportation, accounting for the largest contributions towards transaction volumes.

The number of mega-deals whose values exceed R10 billion has remained consistently high from 2021 through to H1 of 2023. In 2021, a total of 53 mega-deals were completed, amounting to R2.5 trillion in value. In 2022, there was a decrease in the number of mega-deals, with 43 completed deals, amounting to R2.3 trillion. For H1 of 2023, a substantial number of 15 mega deals were completed, amounting to R683 billion. The average mega deal size has significantly improved by 120% in 2021 following the Covid-19 pandemic in 2020. However, 2022 has seen a slight decline of 5%. Fewer and slightly smaller deals indicate that buyers are revaluating their strategy, leading to a preference for smaller, less capital-intensive transactions. China, the UK, and the US have been dominant players in the industry from 2022 to H1 of 2023. The US leads in the mega-deal activity in H1 of 2023, with European countries, such as the Netherlands, Switzerland, and the UK following in the mega deal activity.

Notable Global M&A transactions

An investor group, led by Abu Dhabi Investment Authority acquired a stake in VTG Aktiengesellschaft, R127.7 Billion.

SAS Shipping Agencies Services’ acquisition of Bollore Africa Logistics during December for R105.1 Billion

Phillips 66 acquisition of minority stake in DCP Midstream LP, R165.8 Billion

An investor group led by IFM, completed the acquisition of Sydney Airport Limited for R376.6 Billion.

M&A activity in the African Landscape

African M&A Transactions

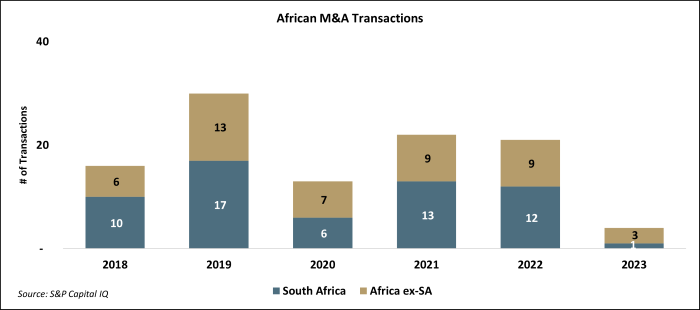

In reference to the below illustration of the recent publicly known African and South African M&A Activity within the Logistics sector. Accounting for approximately 1% of all global transaction volume in the global Logistics sector, Africa’s contribution to overall M&A activity has been declining, falling from a high of 1.4% in 2019 to a low of 1.1% in 2022. This persistent downward trajectory has continued into H1 of 2023 year-to-date with African M&A activity accounting 0.2% of Global activity for the year-to-date.

African M&A Transactions by sub-sector

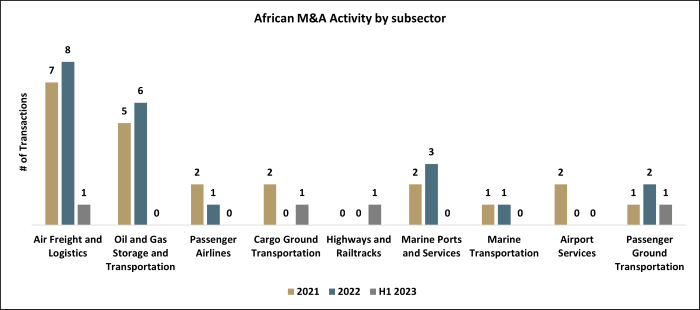

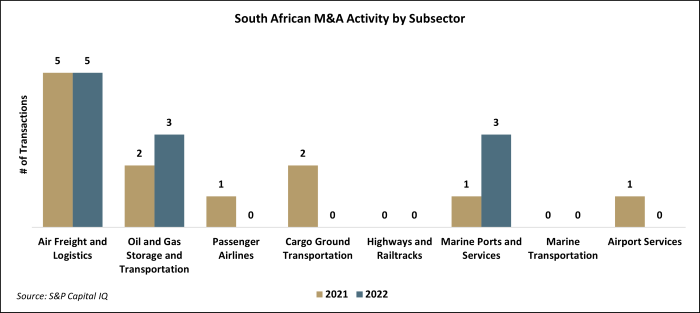

Given the distinct challenges faced in the African M&A environment such as economic and political instability, market fragmentation and limited availability of target companies, currency and exchange rate risks, infrastructure constraints, access to capital, and cultural and managerial differences. African M&A activity within the logistics sector has been dislocated from Global M&A activity. Divergent to the emerging trend in the Global overall logistic transaction volumes, sub-sector contribution to the overall logistics activity has experienced variability between 2021 and H1 of 2023. Air Freight and Logistics, Oil and Gas Storage and Transportation and Marine Ports and Services accounting for the largest contributions towards transaction volumes. Given South Africa’s outsized impact on the African continent, it plays a pivotal role in transaction volumes, with the same aforementioned sub-sectors making substantial contributions to South African M&A activity.

Heavily dependent on mineral extraction and agriculture production export markets for growth, further economic integration through economic blocs (like SADC, EAC, and ECOWAD) and trade agreements (like AfCFTA and AGOA) will be critical factors in driving Africa’s future development by gaining preferential access to markets, diversifying exports, and attracting increased foreign direct investment. These tailwinds are anticipated to spur further growth and activity within African Logistics sector.

South African M&A Transactions by sub-sector

Consistently contributing towards 60% of total African transaction volumes, South Africa continues to contribute a significant majority of total African M&A Transactions within the logistics sector. South African Logistics M&A activity has decreased significantly from the second half of 2022 (4 completed transactions) to H1 of 2023 (1 completed transaction) of about 75%. Additionally, there was a 60% decline when comparing H1 of 2022 to H1 of 2023. Throughout 2022 there has been several transactions in the Air Freight and Logistics Subsector and the Transportation Infrastructure and Services Subsector (Airport and Marine Port Services, Highways and Railtracks Infrastructure), which accounts for 80% of logistics sector deal volumes in the country. Whereas in H1 of 2023 there has only been 1 completed transaction in the transportation infrastructure and services subsector.

Notable South African M&A Transactions

DP World’s acquisition and subsequent delisting of Imperial Logistics during March for R22,3 billion, providing the company an entry into South Africa and strengthening its footprint as a global end-to-end logistics provider.

African Infrastructure Investment Managers’ (“AIIM”) led acquisition of The Logistics Group during March for R1.6 billion, bolstering AIIM’s transport strategy in Southern Africa by addressing ports and inland transport capacity deficits.

Remgro Limited completed the spin-off of 25% stake of Grindrod Limited valued at R1,6 billion

Intertoll Europe ZRt. completed the acquisition of a 50% stake in Bombela Concession Company (Pty) Ltd for R1,4 billion