What is Sustainable Infrastructure?

Sustainable infrastructure refers to the equipment and systems that are designed to meet the population’s essential service needs (i.e. houses, highways, energy, etc.), with the aim of developing infrastructure that is environmentally friendly from end-to-end, and which encompasses economic, financial, social and institutional factors.

Sustainable Funding

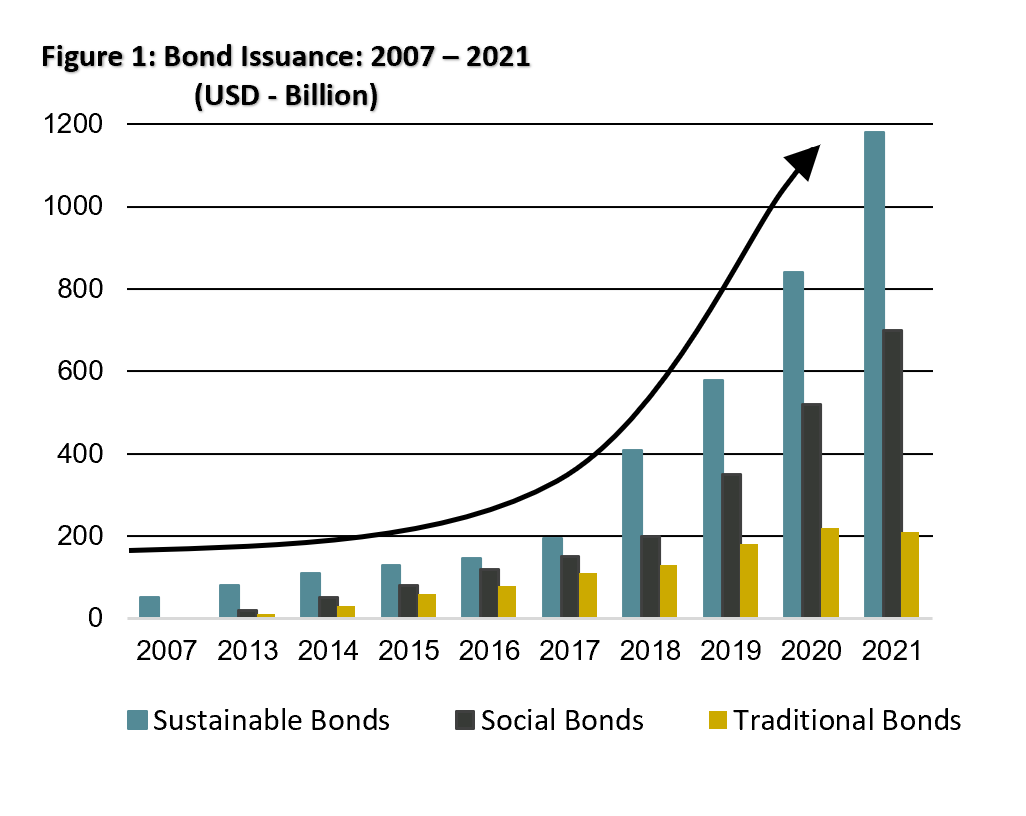

Sustainable Funding is an attractive opportunity for businesses and projects seeking to obtain funding for operations that focus on generating revenue under the Green and/or Sustainability Segments of the debt capital market. The relevant funding should be applied to initiatives which strive to achieve the Sustainable Development Goals (SDG’s) as set out by the United Nations. Sustainability funding represents a distinct opportunity for current and future sustainable developers seeking to raise equity and/or debt capital by way of Social, Sustainability, and/or Green bonds. The JSE has recently expanded on their Sustainability Segment by allowing for the listing of Sustainability-linked Bonds and Climate Transition Bonds. As it stands there are, approximately ZAR10.5 billion (USD700 million) worth of debt programmes registered with the JSE under their Sustainability Segment alone.

Sustainable Infrastructure Funding

Sustainable infrastructure funding is designed for companies and projects/initiatives/developments that achieve the following objectives:

- reducing the environmental and carbon footprint;

- fostering renewables;

- creating green employment; and/or

- driving green economic growth.

Should this be in line with your business development goals, sustainable funding options may be the way to get your project over the line.

Impact Investing

The Global Impact Investing Network (“GIIN”) introduced a unique narrative to traditional investing called: “Impact Investing”, which can be described as an investment made into any company or project with the intent to generate measurable, social and/or environmental impact, alongside financial returns. The point of impact investing is to use money and investment capital for positive social and/or environmental results, in addition to financial gains.

Impact Results

Most impact investors seek returns that are comparable to market rates, and in some instances impact investments have shown to outperform the market. Impact investing is part of a growing trend of social and environmental practices designed to reduce the negative outcomes associated with traditional business activities. The GIIN indicates that more than 88% of impact investors’ expectations were met or exceeded.