Industry Outlook

downward trend in activity in 2022 has persisted through to 2023, with H1 2023 year-to-date down 23% in transaction volume in comparison to H1 2022

In reference to the below illustrations of the recent publicly known global M&A Activity within the overall industrials sector from 2021 to H1 2023. Despite the combined constraints of trade sanctions, disruption to global supply chains, persistent inflation, the ongoing conflict in Ukraine, and increasing financing costs, global M&A activity has remained resilient within the overall industrials sector returning to similar activity levels seen in 2017.

Since the highs of 2021, where we saw an increase of 16% in transaction volume from 2020, largely influenced by the outbreak of the COVID-19 pandemic in 2020, and subsequent reopening of the global economy in 2021. As the fears of higher inflation in the latter half of 2021 spilled over into 2022, global M&A activity in the overall Industrials sector has cooled in 2022 falling by 6% in the number of transactions completed compared to 2021. Unlike H2 2021 which saw a 21% increase in transaction volume from H1 2021, H2 2022 saw a 5% decline in transaction volume from H1 2022. This downward trend in activity in 2022 has persisted through to 2023, with H1 2023 year-to-date down 23% in transaction volume in comparison to H1 2022. Geographic contribution towards M&A Activity has remained constant with the US, Europe, and Asia accounting largest contributions towards transaction volumes.

Global M&A transactions

Sub-sectors contribution to overall industrial M&A activity has remained consistent over the period from 2020 through H1 2023, with Business Services, Engineering and Construction, and Industrial Manufacture accounting for the largest contributions towards transaction volumes. The cooling in total transaction volumes in 2022 was not reflected in the number of mega-deal (values above R10 billion) with the number of transactions remaining flat, however with a 13% increase in aggregate transaction value from R6 trillion to R6.8 trillion. The trend of increasing mega-deal aggregate transaction value on a declining number of number of transactions has persisted in H1 2023, with number of mega-deal transactions declining by 28% in comparison to H1 2023, however with mega-deal transaction value remaining flat at R2,7 trillion. Geographic contribution to mega-deal transactions has mirrored total overall industrial activity with the bulk of transactions occurring in US, Europe, and Asia.

Notable global M&A deals

Brookfield Business Partners led investor group’s acquisition of Nielsen Holdings during October for $15.5 billion.

SAS Shipping Agencies Services’ acquisition of Bollore Africa Logistics during December for $6.1 billion.

KKR’s acquisition of a 60% stake in Hitachi Transport System during November for $5.6 billion.

Clayton, Dubilier & Rice’s acquisition of Cornerstone Building Brands during July for $3.9 billion.

Global M&A activity within the overall industrials sector is expected to stay steady throughout the remainder of 2023, despite the persistent uncertainty and fallback from past years’ supply chain issues. The pandemic enforced shutdowns, followed by the 2022 semiconductor shortage, further illustrated the need to build more resilient supply chains and the importance of domesticating the supply of critical components and lessening the reliance on cross-border suppliers as the world shifts to a multi-polarity. As a result, M&A remains an appealing strategy in achieving this.

At the same time, renewable energy and the energy transition are as much in focus for many industrial companies. Industrial players have been quick to acquire access to favourable green markets and capabilities to accelerate reductions in water and carbon usage to help improve their production and manufacturing capabilities in pursuit of their own ESG objectives. Consequently, many companies are expected to ramp up R&D efforts, as they strive to meet their goal of net-zero carbon emissions by 2050. Only increasing the importance of M&A as a means meeting these objectives. Although overall transaction volumes are lower, we have seen an increasing number of ESG-driven acquisitions among industrial players looking to accelerate broader environmental and social objectives. While it is difficult to quantify M&A activity based on ESG dimensions, the sector has a higher-than-average number of ESG components included in its transactions, and it is anticipated that at least 10% of transactions within space now has an ESG component.

The automotive sector is expected to drive further activity in the medium term as new emerging technologies and the ongoing transition to electric vehicles are facilitating a hyper-competitive environment where M&A will be a critical component in maintaining an edge over competitors. Likely remain vulnerable to global headwinds in 2023 including slower global demand and continued supply-chain problems. However, the sale of electric vehicles is expected to grow by 25% year-over year to nearly 11 million units in 2023. As legislative branches get more innovate with policy incentives to encourage further production, automakers are accelerating their investments in recharging solutions, including battery swapping.

M&A activity in the African Landscape with a focus on South Africa

African M&A transactions

In reference to the below illustrations of the recent publicly known African and South African M&A Activity within the overall industrials sector. Accounting for approximately 1% of all global transaction volume in the global overall industrials sector, Africa’s contribution to global M&A activity has been declining, falling from a high of 1.4% in 2019 to a low of 0.9% in 2022. This persistent downward trajectory has continued into H1 of 2023 year-to-date with African M&A activity accounting 0.7% of Global activity for the year-to-date. Falling from a high of 49% in 2020, South Africa continues to comprise a significant majority of total African M&A Transactions within the sector accounting for 45% of the transaction volumes for 2022.

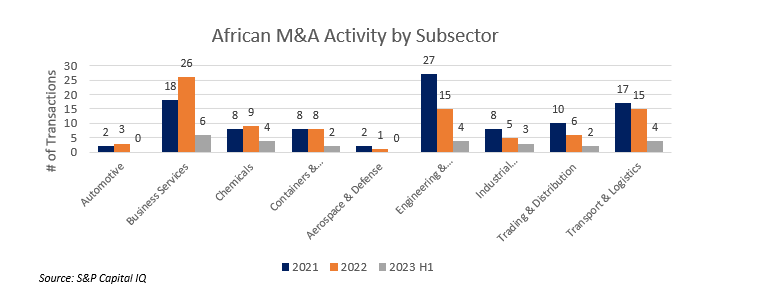

Given the distinct challenges faced in the African M&A environment such as economic and political instability, market fragmentation and limited availability of target companies, currency and exchange rate risks, infrastructure constraints and access to capital, and cultural and managerial differences. African M&A activity within the overall industrials sector has been dislocated from Global M&A activity. Divergent to the emerging trend in the global overall industrial transaction volumes, sub-sector contribution to the overall industrial activity has experienced greater variability. With Business Services, Engineering and Construction, and Transport and Logistics on average accounting for the largest contributions towards transaction volumes. Given South Africa’s outsized contribution to African M&A activity, it is expected that the South African sub-sector contribution towards transaction volumes would be fairy similar although slightly different with Business Services, Industrial Manufacture, and Transport and Logistics accounting for the largest contributions to South African M&A Activity.

African M&A transactions by sub-sector

South African M&A transactions by sub-sector

In line with Africa’s contribution to total overall industrial M&A activity, Africa accounted for a small fraction of overall mega-deal activity with two mega deals concluded in 2022 and which unsurprisingly occurred in South Africa.

Notable South African M&A transactions

DP World’s acquisition and subsequent delisting of Imperial Logistics during March for R22,3 billion, providing the company an entry into South Africa and strengthening its footprint as a global end-to-end logistics provider.

Ardagh Group’s acquisition of Consol Holdings during April for R10,1 billion, expanding their glass production capabilities in Africa.

Masimong Holding’s acquisition and subsequent delisting of ARB Holdings during July for R696 million, improving ARB’s B-BBEE scorecard.

African Infrastructure Investment Managers’ (“AIIM”) led acquisition of The Logistics Group during March for R1.6 billion, bolstering AIIM’s transport strategy in Southern Africa by addressing ports and inland transport capacity deficits.

As the African M&A landscape continues to evolve, with some sectors and regions within the continent having seen increased M&A activity in recent years. As African economies continue to develop and address some of these barriers, it is expected that there may be opportunities for increased M&A activity in the overall Industrials sector which would see contribution to global volumes increase above the current 1% level. Continuing its downward trajectory in H1 of 2023, falling to 36% of overall industrial M&A activity in Africa, South Africa’s contribution to African overall Industrial transaction volumes is anticipated to continue falling. In line with the general trend, mega-deals are also expected to continue their slow down amid the current market uncertainty, however smaller capability-driven deals are expected to continue as industry participants look to consolidate. Although subdued, further African M&A activity in 2023 is expected to be driven by –

Trends driving M&A activity in African industrial subsectors..

Business Services

-6 transactions for H1 2023, down 54% on H1 2022

-Diverse and highly fragmented with a few participants holding majority of the market share in their respective areas. Given the presence of private equity firms within the industry, rollup and consolidation acquisitions are increasingly likely as private equity firms look to build sizeable targets with the aim of selling to market leaders.

-Difficulty in obtaining skilled labour in knowledge-work areas are expected to fuel talent-based acquisitions within the industry. Scope acquisitions are expected as complementary services help to unlock economies of scale while providing acquirers access to adjacent high-growth business areas.

Chemicals

-4 transactions for H1 2023, down 20% on H1 2022

-Acquisitions within and around existing operating footprints are expected to become more prevalent as investors look to consolidate their positions within predetermined operational geographies. Acquisitions outside of these geographies will be less likely given increased supply chain challenges and a lack of scale economy benefits.

-Divestment of non-core assets and assets within non-core geographies are expected to create acquisition opportunities as business look to refocus their operations amid inflation and margin pressures.

-Expansion into new verticals is less likely to occur given the cyclicality of the chemicals industry and the current stage of the business cycle. These acquisitions are however not improbable.

Engineering & Construction

– 4 transactions for H1 2023, down 60% on H1 2022

-Higher inflation and increasing costs of commodities have increased pressure on margins. Companies looking to contain costs are expected to divest non-performing assets or implement vertical expansion strategies to capture value along the supply chain.

-Increasing interest rates are expected to halt demand for new construction projects, dampening growth within the sector. Construction & Engineering companies pressured by shareholders to meet growth targets are expected to diversify their operations into adjacent high growth business areas.

-Specifically, consolidation is expected within the Cement industry in South Africa with large players such as NPC looking for a suitor.

Industrial Manufacturing

-3 transactions for H1 2023, down 50% on H1 2022

-Industrial manufacturing players are expected to pursue capability-driven acquisitions to help build supply chain resilience. Focus areas are likely to include cost efficiency, technological and innovative capabilities, digital deployment, additive manufacturing, and industrial automation.

-Shift toward ACES (autonomous, connectedness, electrification, and shared mobility) is likely to spur transactions as companies embrace the 4th industrial revolution.

-Industrial manufacturing companies are likely to consolidate at the OEM and supply-chain levels to reduce fixed costs, gain competitive scale, increase downturn resilience, and strengthen supply chains.

-Expansion into the services, aftermarket and parts businesses are likely as these business areas provide manufacturing firms with access to more profitable business lines while maintaining a relatively stable asset base.

-Companies showing strength and resilience in the face of sustained load-shedding are expected to attract the attention of their acquisitive competitors.

Transport & Logistics

-With the Middle East, in particular the UAE and Saudi Arabia, and China fixing their gaze on Africa as the basis for their economic diversification strategies with the regions pouring billions into Africa through acquisitions and transport infrastructure development projects.

-Large multinationals looking to maintain their influence within the continent are expected to strengthen their position via acquisitions and strategic partnerships in key countries including South Africa, Egypt, Algeria, Tanzania, Kenya, Mozambique, and Senegal, among others.

The 2022 mergers and acquisitions environment was largely affected by the uncertainty of macroeconomic and geopolitical events, casting a shadow over the growth prospects and profitability of the sector.

We are however optimistic that industrials M&A activity, in both the South African and international markets, will improve during 2023. Acquisitions and divestitures related to scale, scope, and capabilities will ensure a healthy level of deal activity throughout the year.