Industry Outlook

Accelerating at a CAGR of 11%, the global sports betting market, a sub sector of the casino and gambling industry, is anticipated to expand by USD 144 billion between 2021 and 2026. Considered moderately competitive and fragmented, the sports betting market is characterised by the presence of several global vendors as well various regional competitors. However, competition amongst vendors is intensifying driven by the legalisation of sports betting across diverse jurisdictions, the digitization of gaming offerings, and the heightened commercialisation of sports.

Trends expected to drive M&A activity in the sector

Legalisation of sports betting across diverse jurisdictions

-For gaming vendors, regulatory liberalization across diverse jurisdictions is creating a more favourable business operating environment. Legalised sports betting expands the betting population from both an online footprint and within brick-and-mortar locations. With wagering on sports increasing, it is anticipated that the popularity of sports betting will continue. Especially as additional countries and US states take steps to supplement their revenue streams by legalizing online sports betting with more than half of the US states having or in the process of doing so. Several countries including Nigeria, Kenya, and South Africa have been legalising and regulating sports betting in recent years. With central European markets such as Switzerland and the Czech Republic continuing through the stages of opening to online casino gaming. This is evidenced by Bragg Gaming Group making is sixth new market entry over the last 12 months in debuting its exclusive iGaming content in the Czech Republic in partnership with SYNOT Group, via its SYNOT INTERACTIVE platform, and announcing a strategic content deal between its subsidiary ORYX Gaming and leading licensed Swiss vendor Grand Casino Luzern’s asset mycasino.ch.

Digitisation of gaming offerings

-The pandemic escalated traditional gaming vendors in embracing online gaming and sports betting. With the shift from attending brick-and-mortar gaming outlets towards players participating on their smart devices from the comfort of their own homes. Vendors significantly increased online gambling and sports betting revenue underscoring the viability and importance of these supplemental revenue streams for the gaming industry.

-This was evidenced within the South African gaming market. Recovering from the lows during the pandemic, the gaming industry has boomed over the past 2 years, with the National Gambling Board of South Africa showing a 48% increase in market size from R23.25 billion in 2020/21 to R34.43 billion in 2021/22. The pandemic materially altered the structure of gaming market, with betting revenue instantly comprising of nearly all revenue as brick-and-mortar channels were closed and players turned to betting as the only form of gaming available and accessible online.

-The continued migration to digital is also being aided in part by a growing number of vendors launching free play games to players. The challenge for vendors is to personalise and localise their offering in each market if they are to enjoy the same success they have had in their existing markets. Free play games help to engage, educate, and acclimate players to wagering online or via their smart devices, and is also building trust between players and vendors. While vendors introduce a growing range of new products to maintain player engagement, they must remain vigilant regarding the need to reduce customer acquisition costs.

-This was evidenced within the African and South African gaming market with mobile-focused venders delivering new products to players helping take engagement to new heights. Such as Kiron Interactive debuting its virtual sports game, Marshalls launching Ezugi’s live casino content to its players, and Hollywoodbets offering its players access to Evolution Gaming’s live casino games for the first time with minimum bets as low as R1.

-Although the sports betting market faces further competition from the overall player discretionary spending on other activities such as online fantasy sports platforms and alternative entertainment and gaming options. It is anticipated that daily fantasy sports, online sports betting, esports, virtual reality experiences and traditional online gaming will continue to gain market share over traditional brick and mortar outlets.

Heightened commercialisation of sports

-As regulatory shifts have enabled broadcasters and publishers to start generating ad revenue from gaming vendors and incorporating betting content to their platforms. The ties between media outlets and gaming vendors have only deepened with Sports Betting becoming a vital and growing piece of sports media. Media and sports have become so reliant on each other, with the lines between them increasingly opaque.

-Broadcasters and publishers strive to maintain audience engagement and are enticed by the potential for additional revenue through advertising, referrals, and brand-licensing fees. In contrast, gaming vendors seek assistance in attracting new players and enhancing retention rates, all while minimising associated costs. As a result, even esteemed publishers such as Sports Illustrated have pursued brand licensing agreements with sportsbooks, with Penn National Gaming buying Barstool Sports and Score Media and Gaming as marketing vehicles for its sportsbooks in the US and Canada. On the South African front, this is illustrated by Multichoice’s stake in BetKing.

-This commercialisation is further demonstrated by major sports leagues such as the NFL, NBA, and Premier League embracing betting as a facet of the fan experience, enabling more ads to air in game broadcasts, more types of wagers to be placed, and alternate streamers that are made for players. This is reflected by the American Gaming Association showing that almost 47 million Americans having placed a wager on the season’s NFL games as of September 2022. This has also seen the emergence of the partnership between LIV Golf and Simplebet which aims to integrate sports betting by allowing viewers to wager through partner books like DraftKings and Bet365. Although headwinds could also be on horizon, as the Premier League in conjunction with the UK Betting and Gambling Council, have announced the plan to remove Sportsbook sponsors from the front of team shirts from the 2024/2025 season onwards, becoming the first UK professional sports league to voluntarily agree to restrict betting sponsorships.

-Other media companies, including Disney, have expressed interest in expanding their involvement in the sports betting industry, with FanDuel relaunching its horse racing TV subsidiary as its own sports-betting network, FanDuel TV, and startups such as PickUp and Data Skrive working with publishers to help engage sports fans with their content.

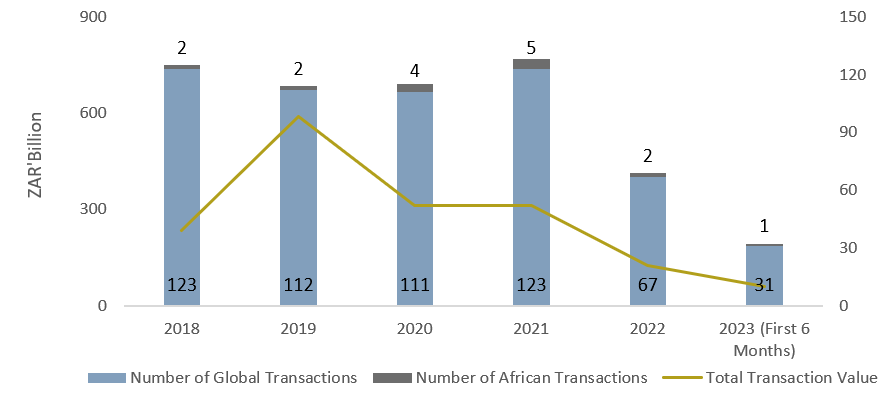

Above is an illustration of the recent publicly known global and regional M&A Activity within the overall casino and gambling industry. Although increased competition, economic uncertainty, and increases in the cost of capital has led to a significant slowdown in overall deal activity in 2022 and continuing into the first half of 2023 as potential acquisition targets more expensive. Online Gaming and Sportsbooks with much lower operating costs than traditional brick and mortar vendors will continues to outstrip broader casino and gambling market growth through the continued expansion of electronic casino games and adoption of cashless gaming and digital payments. As a result, even if recessionary pressures prove to be a drag on consumer spending in the months ahead, this will likely impact online gaming and sportsbooks sectors differently. It is anticipated that pre-pandemic M&A drivers, such as market fragmentation, the benefits of scale, and the importance of product offering and platform diversification, will continue to be driving forces of sport betting M&A activity going forward.

Notable global M&A deals

The intensifying competition in the sports betting market and the demand for inorganic innovation has resulted in market consolidation. Many major market vendors are engaging in M&A to grow inorganically and increase their market share. Specifically related to online gaming, we have recently seen significant M&A activity involving some of the largest gaming vendors globally. Larger vendors with deeper resources have been better able to manage the impact of the pandemic and are well positioned to acquire smaller vendors at discounts from their pre-pandemic valuations. The result of all this activity has been a flurry of new partnerships, mergers, and acquisitions in the industry, including from Bragg Gaming Group, Penn National Gaming, Landcadia Holdings, Caesars Entertainment, and GAN Limited.

Bragg Gaming group’s acquisition of Spin Games LLC

Penn National Gaming’s acquisition of Barstool Sports

GAN Limited’s acquisition of Silverback Gaming

Eldorado Resorts’ acquisition of Caesars Entertainment Corporation

Africa's growing betting industry

Although a lot of the industry’s attention has been firmly fixed on the North American market. Many other jurisdictions have seen incredible progression, especially on the African continent. The largest determinants impacting gaming in Africa being telecommunications and demographics. As internet connectivity and coverage continues to grow and improve, the rise in smart device penetration means that more players than ever before have access to online and mobile sportsbooks. As result online revenue is estimated to be 25% of overall gaming revenue in 2021, a 22% increase from the previous period. The other likely catalyst for Africa’s growing betting industry can attributed to the number of young people on the continent with more than 200 million people between the age of 18 to 24 which make about 16 percent of the continent’s overall population. Mainly dominated by football and horse racing, it is no secret that betting is an activity that is particularly popular among the youth. Where high adoption of betting often been attributed to the high unemployment rates and economic decline as more people seem willing to take their chances to escape certain financial realities. This is exemplified in Africa’s most populous country, Nigeria, which has about 60 million adults in general who engage in sports betting out of a total population 213 million, representing a sizeable local market.

As vendors find their feet in individual African markets, we are starting to see successful vendors enter new jurisdictions. Previously, it was only the purview of big European vendors such as Betway and Editecs that had operations spanning multiple regions. Now we are seeing lower-tier vendors extend their reach. Such as Playgon going live in South Africa with its partner Intelligent Gaming, Kenyan operator Odibets launching into Ghana, Powerbets entering South Africa, Bingwabet securing a licence in Mozambique, and Cola entering in several markets simultaneously alongside Betika, GAL Sports Betting, SportyBet, Bangbet, and BetKing. This thriving market has led to some serious M&A activity with the African and South African landscape over the last few years. With MultiChoice increasing its stake in BetKing for an additional USD 280 million, WSB acquiring iDiski TV for an undisclosed sum, Betfred acquiring Betting World for $6.7 million securing a foothold in the South African betting market and Sun International concluding a 70% investment in SunBet Africa Holdings for a consideration of $3.2 million. Currently accounting for between 2% and 3% of Sun International’s gaming income at just under R400 million, the target is to grow this 5-fold to 26% which is approximately R2 billion in gross gaming revenue in about 2026. With its enormous potential, the African sports betting market is poised to become a major force, and we anticipate that the industry will recognise this reality in the coming years resulting in further acquisitions and consolidations.

Although the African Sports Betting sector stands on the precipice of an expansionary era with South Africa and the rest of the continent presenting opportunities for emerging startups as well as established global gambling companies. The implementation of successful acquisition growth strategies is not guaranteed. This is highlighted by MultiChoice’s unsuccessful investment of approximately R5.9 billion for a 49% stake in KingMakers (formerly BetKings), from which Multichoice had to write-off around R1.3 billion on its investment. Since is partnership, KingMakers has faced multiple challenges in realizing its potential, with higher-than-anticipated costs related to revenue growth leading to significant losses. MultiChoice attributes these losses to investment efforts to scale the business, cash extraction losses in Nigeria, unsuccessful expansion plans, and KingMakers’ exit from operations in Kenya and Ethiopia.

When targeting gaming and betting companies and sportsbooks, acquirers should align their strategies, augment due diligence processes, and prioritize business continuity. As the African market comprises of numerous private players, adopting an initiative-based strategy for outside-in target screening and sourcing, conducted on a market-specific basis, can provide substantial benefits by facilitating access to favourable transactions. Proactive engagement with potential targets not only enhances the probability of early access but also fosters the development of trust-based relationships, thereby setting acquirers apart in competitive negotiations. Effective target screening entails a comprehensive evaluation of strategic alignment, including considerations of value capture potential and synergies, along with the identification and mitigation of operational and political risks. Acquirers should seek insights into future market penetration, corresponding customer acquisition costs and asset valuations and assess risks with local experts. Market knowledge is crucial for evaluating the target’s strengths, development capabilities, track record, and overall potential. Consequently, the acquirer’s development team should actively contribute to the M&A process by assisting in sourcing and screening activities.

Given the dynamic landscape of the gaming and betting industry, where companies must maintain competitiveness to partake in the flow of deals. The complexities and potential challenges inherent in these transactions highlight the added advantage of soliciting professional advisory services in effectively guiding and navigating growth acquisition strategies and risk mitigation within partnerships. As a trusted independent corporate finance house in existence for more than 20 years, let us guide you as your M&A advisory experts.