Over Half of South African CEOs Express Doubts About BRICS Benefits, Reveals CCI Q3 Questionnaire

Merchantec CEO Confidence Index increased 10% while Basic Resources experienced a 24% decline

This quarter’s Merchantec CEO Confidence Index (MCCI) revealed that 55% of CEOs harbor doubts regarding the potential benefits of South Africa’s association with BRICS (Brazil, Russia, India, China, and South Africa). The questionnaire aimed to gauge perceptions regarding whether BRICS could offer South Africa opportunities for trade, investment, and technology exchange that could contribute to the nation’s economic growth and development.

The results, which have generated substantial interest in the business community, suggest that a significant portion of South African CEOs do not view BRICS as a remedy for the nation’s economic woes. One of the prominent concerns voiced by CEOs is that BRICS members are not substantial trading partners for South Africa when compared to existing key partners like the United Kingdom and the United States. Some CEOs even expressed apprehension that closer ties with BRICS might alienate these existing trade partners, possibly due to perceived conflicts of interest.

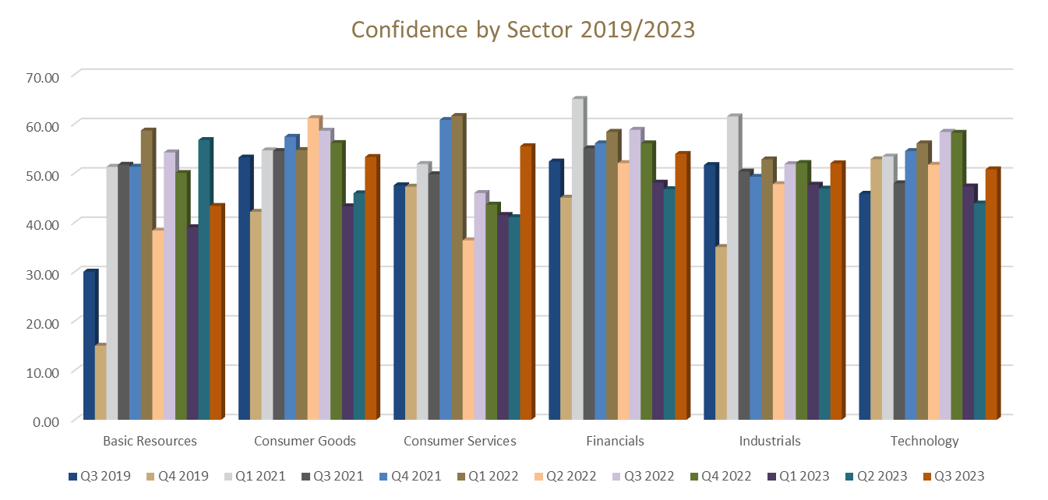

Furthermore, the current economic climate in South Africa has left many CEOs uninspired and lacking confidence. Businesses are struggling with persistent power outages, logistical challenges, corruption, and high-interest rates, making it increasingly difficult to operate. Despite these challenges, the MCCI recorded a 10% improvement in CEO Confidence between Q2 and Q3 of 2023. This increase in overall CEO confidence in South Africa is demonstrated by rising confidence in the following sectors: Consumer Goods, Industrials, Financials, Information and Communication Technology, and Consumer Services, reaching 51.4 points in Q3.

Consumer Services recorded the largest increase in confidence at 35% moving to a score of 55.42. This sentiment was attributed to a 34% increase in confidence relating to company growth expectations.

Consumer Goods recorded an increase in confidence for Q3 2023, rising 16% from 45.88 to 53.24 points, moving above the neutral score line of 50 points. The rise in sentiment was primarily driven by a 35% increase in confidence relating to economic conditions and an increase of 17% in company growth expectations.

Technology increased by 16% in confidence in Q3 2023.

Financials recorded a 15% increase in confidence. This sentiment was attributed to a 68% increase in confidence relating to economic conditions and an increase of 23% in company growth expectations.

Industrials saw a 11% increase in confidence, moving to a score of 51.96. The increase in overall confidence was primarily driven by increases in economic conditions and industry growth expectations.

Basic Resources confidence dropped by 24% in Q3 2023, after leading in Q2 2023. The drop in confidence is attributed to a 64% decrease in confidence relating to economic conditions, a 22% decrease relating to the planned level of investment, a 14% decrease in confidence relating to company growth expectations, a 14% decrease relating to their ability to secure debt or equity capital, and a 9% decrease in confidence relating to industry growth expectations. However, there was a notable confidence increase of 22% relating to planned level of investment.