Global Overview

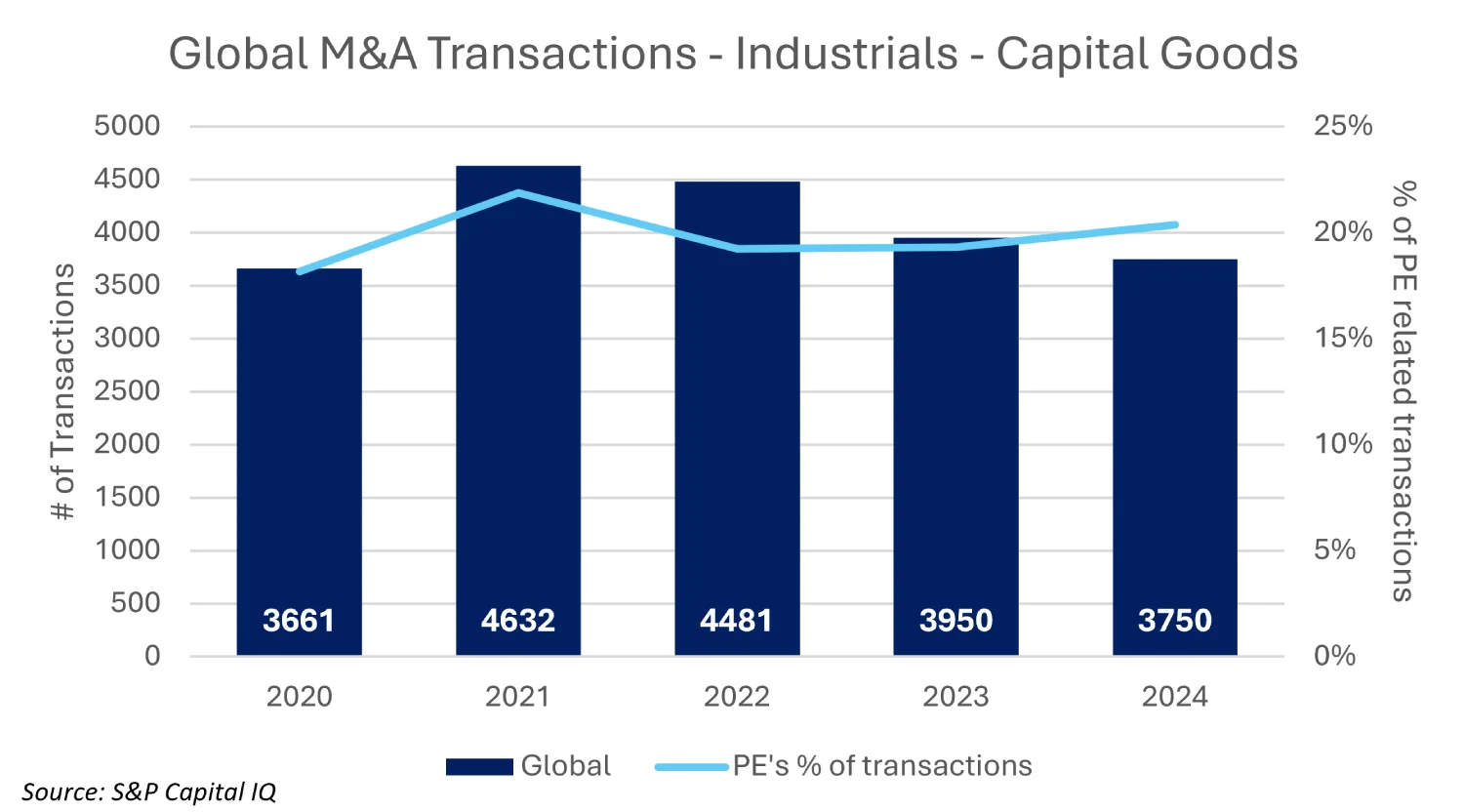

The illustrations below highlight recent publicly disclosed Global M&A activity within the Industrials Capital Goods industry over the last 5 years from 2020 to 2024.

From the highs of 2021, which saw a substantial increase in transaction volume from 2020, primarily influenced by the outbreak of the pandemic and subsequent reopening of the global economy in 2021. Inflation, the increased cost of capital, and the reconfiguration of global supply chains in response to geopolitical tensions, have seen a persistent downward trend in the total number of completed transactions with global M&A activity within the Industrials Capital Goods industry declining to just above pre-pandemic volumes. Private equity involvement continues to hover around the 5-year average of 20%, indicating that financial buyers are a notable complementary contributor, but not the dominant force driving M&A activity dynamics as strategic buyers continue to contribute significantly to the overall market.

Global M&A transactions

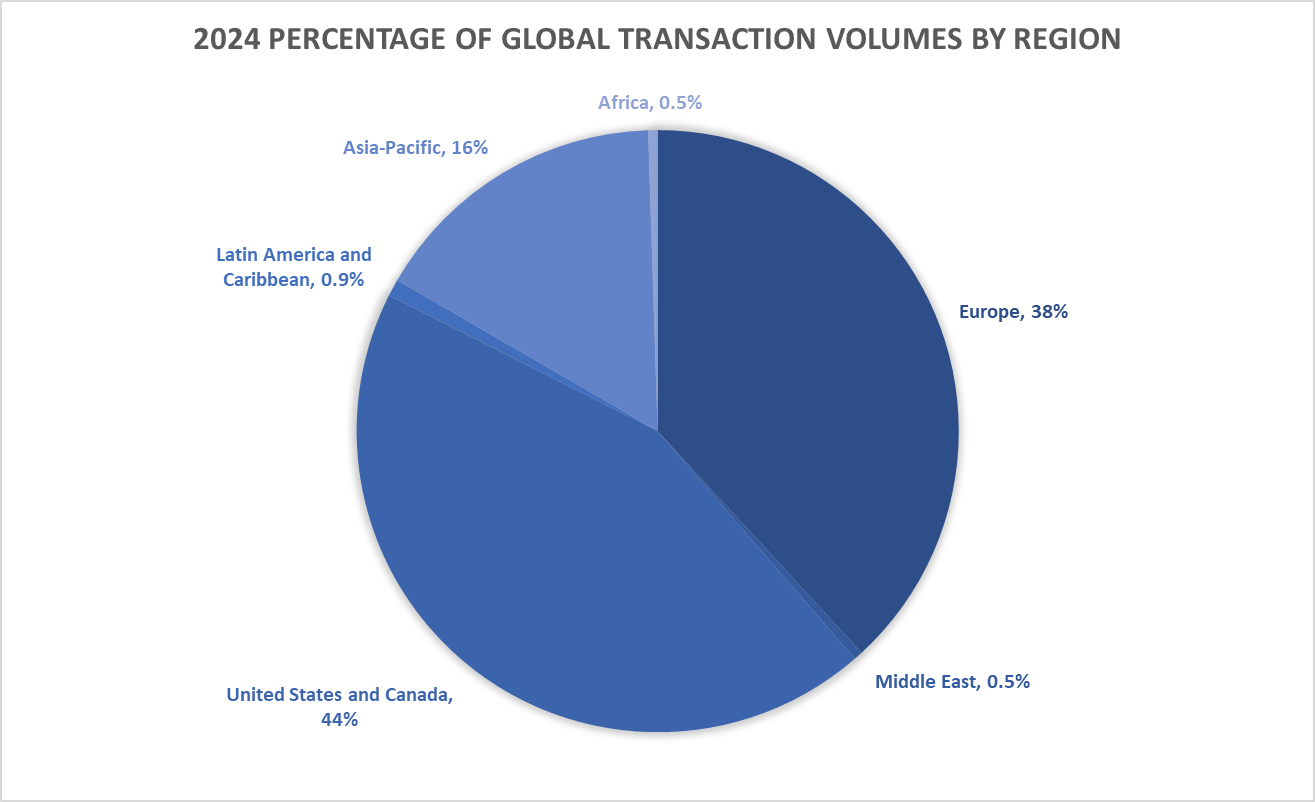

More advanced supply chains, strong vendor networks, and robust infrastructure drive expansion and consolidation opportunities in these regions, geographic contribution towards M&A Activity has remained consistent over this period from 2020 through 2024, with North America (44%), Europe (38%), and Asia-Pacific (16%), accounting for the largest contributions towards transaction volumes in 2024.

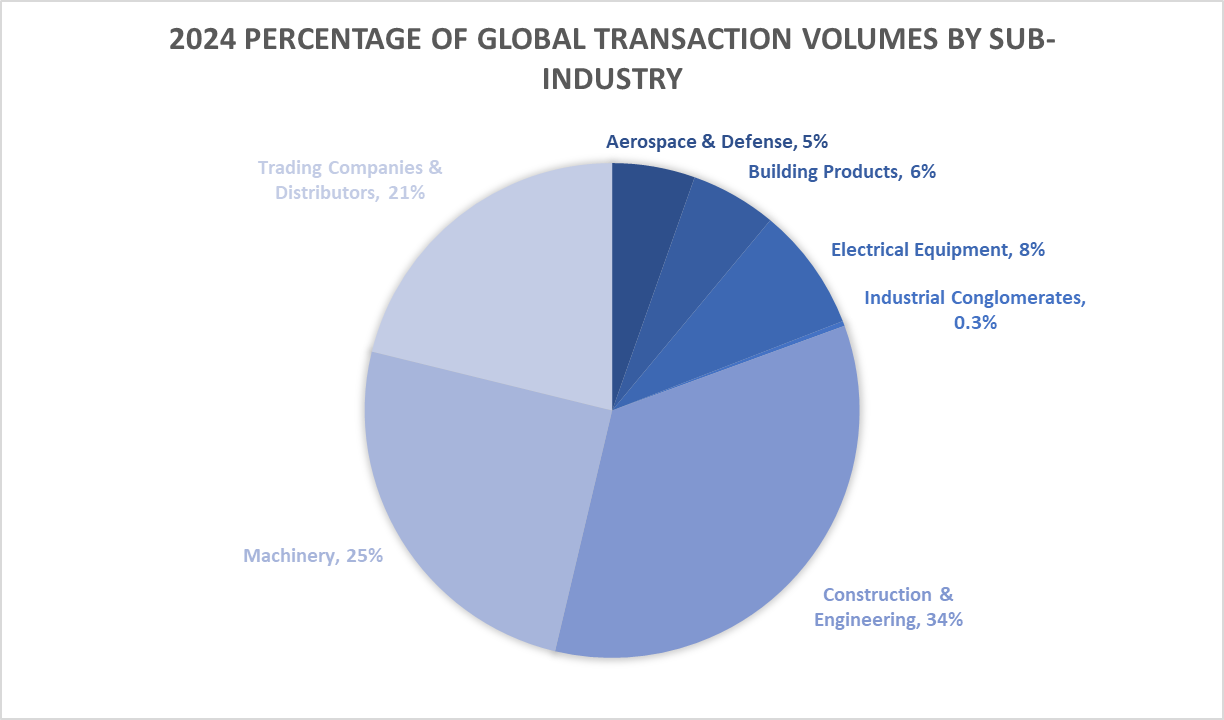

The sub-industries’ contribution to overall Industrials Capital Goods M&A activity has also remained consistent over this period from 2020 through 2024, with Construction and Engineering (34%), Machinery (25%), and Trading Companies and Distributors (21%), sub-industries accounting for 80% of global M&A activity combined in 2024. The Industrials Capital Goods industry comprises various sub-industries detailed in the table below.

Aerospace & Defense

Manufacturers of civil or military aerospace and defense equipment, parts or products, such as defense electronics and space equipment.

Building Products

Manufacturers of building components and home improvement products and equipment.

Construction and Engineering

Companies engaged in primarily non-residential construction.

Electrical Equipment

Companies that produce electric cables and wires, electrical components or equipment. Manufacturers of power-generating equipment and other heavy electrical equipment, including power turbines, heavy electrical machinery intended for fixed-use and large electrical systems.

Industrial Conglomerates

Industrial companies with diversified business activities in three or more GICS Sectors, none of which contributes a majority of revenues. Stakes held are predominantly of a controlling nature and stake holders maintain an operational interest in the running of the subsidiaries.

Machinery

Manufacturers of heavy-duty trucks, rolling machinery, earth-moving & construction equipment, and related parts. Companies manufacturing agricultural machinery, farm machinery, and related parts. Manufacturers of industrial machinery and industrial components.

Trading Companies and Distributors

Trading companies and distributors of industrial equipment and products.

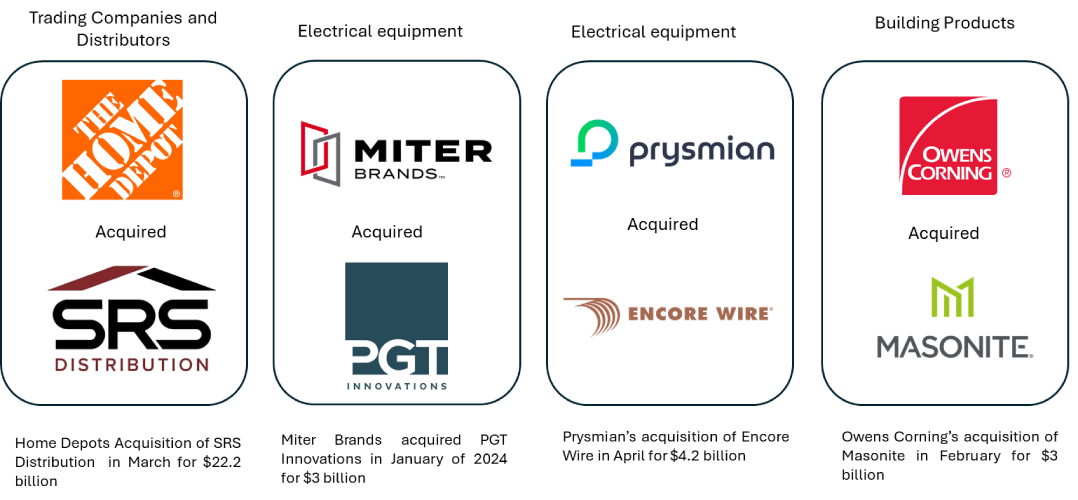

The continued cooling in total transaction volumes in 2024 has also been reflected in the number of mega-deals (i.e., deal values above R10 billion/$530 million) decreasing by 7% from the prior year. Interestingly, the completed mega-deal value in 2024 increased from R2.46 trillion/$134 billion to R2.84 trillion/$154 billion indicating that more players were competing over fewer viable acquisition opportunities driving up valuations. The sub-industries’ contribution to mega-deals is however dislocated from the Global figures with Machinery (24%), Aerospace and Defense (20%), Construction and Engineering (20%), Electrical Equipment (15%), and Building Products (13%) accounting for 92% of mega-deal M&A activity in 2024. Unsurprisingly, geographic contributions to mega-deal transactions were primarily from North America (63%) and Europe (31%) in 2024. Some of the Notable mega-deal transactions from 2024 included –

2025 Global Outlook

Global M&A activity in 2025 is expected to remain resilient within the Industrials Capital Goods industry as favourable macroeconomic factors such as private equity interest, supply resilience, sustainability focus, infrastructure investment and technological innovation are anticipated to drive robust growth.

Key Drivers

Infrastructure Investment

Government stimulus packages, especially in developed economies like the United States (via the Inflation Reduction Act) and Europe (Green Deal initiatives), are driving infrastructure development, creating robust demand for capital goods.

Technological Transformation

Integration of digital technologies like IoT, AI, and robotics into industrial equipment has heightened M&A activity as firms seek to acquire technological capabilities and scale innovation.

Supply Chain Resilience

Companies are restructuring supply chains to mitigate geopolitical risks (e.g., U.S.-China tensions) and reduce dependencies, often through acquisitions in regions with cost-effective manufacturing bases.

Sustainability Focus

Pressure to adopt greener technologies is pushing firms toward M&A strategies that enable access to more energy-efficient machinery.

Private Equity Interest

PE firms are increasingly attracted to the predictable cash flows and long-term demand of capital goods businesses.

African Overview

Global M&A activity in 2025 is expected to remain resilient within the Industrials Capital Goods industry as favourable macroeconomic factors such as private equity interest, supply resilience, sustainability focus, infrastructure investment and technological innovation are anticipated to drive robust growth.

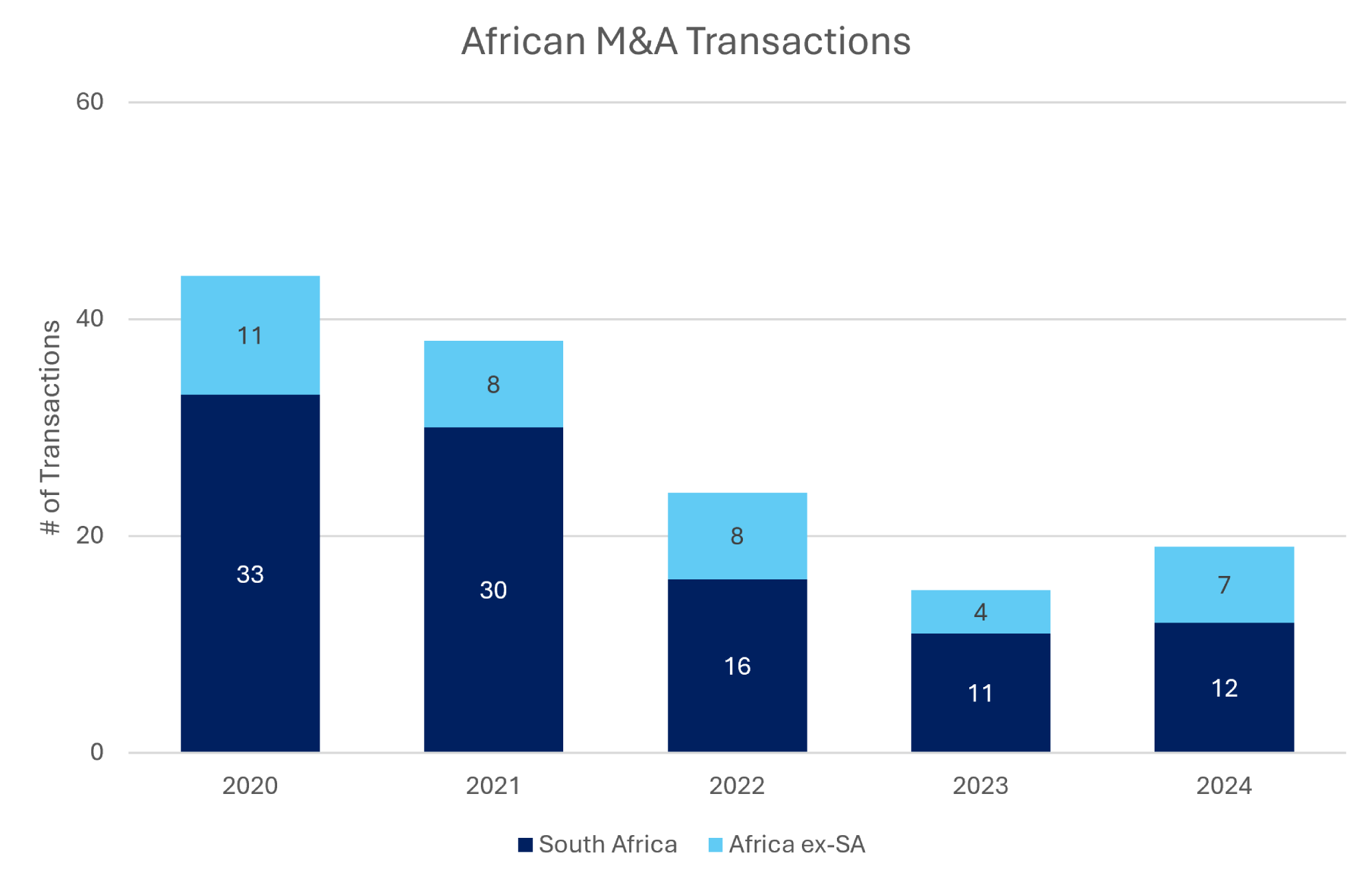

As with most other industries, African M&A activity in the Industrials Capital Goods industry has been dislocated from Global M&A activity as African macroeconomic conditions such as cultural differences, political instability, infrastructure constraints, market fragmentation, access to capital, capital controls, and exchange risks, make successfully sourcing and concluding deals more challenging. In 2024, Africa’s share of global M&A transactions in the Industrials Capital Goods industry accounted for approximately 0.51% of total global transaction volume, reflecting a continued decline from a peak of 1.2% in 2020, but marginally up from a low of 0.38% in 2023. Demonstrating the importance of demand from international strategic trade players looking to gain access to new markets, from a low of 32% in 2021, Cross-Border transactions have risen to a high of 53% in 2024, with 7% of completed transactions in Africa having had Private equity involvement over the last 5 years.

African M&A Transactions

South Africa remains the dominant contributor to African M&A activity. In line with overall M&A activity across the South African economy, M&A activity in the Industrials Capital Goods has been on downward trajectory since 2021. Challenges such as stable electricity generation, water availability, the continued contraction of the mining section, policy uncertainty around empowerment and localization requirements, and misfunctioning transportation networks have had a negative effect on the risk profile of South African companies in the Industrials Capital Goods industry. These impacts on the cooling of M&A activity have been further aggravated by the effects of rising interest rates to counter inflationary pressures and geopolitical uncertainty as players applied caution in seeing how the 2024 national election will unfold. Similar to overall Global M&A activity, Construction and Engineering (42%) and Trading and Distribution Companies (33%) account for 75% of total South African M&A activity in Industrials Capital Goods industry. Some of the Notable African transactions from 2024 included –

2025 African Outlook

With increased interest from international firms looking to enter Africa’s fast-growing markets via joint ventures or acquisitions, African M&A Activity in 2025 is expected to rebound as increasing technological adoption, localization of production, and infrastructure development improve growth prospects.

Key Drivers

Infrastructure Development

Large-scale infrastructure projects driven by organizations like the African Development Bank (AfDB) and national governments are boosting demand for industrial machinery and equipment.

Localization Policies

Governments are encouraging local manufacturing through incentives and public-private partnerships, driving M&A among domestic and regional players.

Modernization of Manufacturing

Firms are increasingly seeking technological partners to adopt automation, AI, and IoT solutions.

2025 M&A activity is likely to center on regional consolidation in South Africa, as multinational players seek to optimize economies of scale. South Africa remains a pivotal player in the Industrial Capital Goods industry in Africa due to its advanced manufacturing capabilities, developed financial sector, and strategic geographic position. With positive developments on electricity availability, collation governments, and transportation infrastructure, local and international players have amplified their pursuit of South African industrial firms with strong fundamentals and the potential to serve broader African markets and diversify revenue streams. This as South African industrial firms start again to increasingly pursue acquisitions in other African and International markets to diversify revenue streams. Further tailwinds in improving demand, growth and activity in the industry are expected from the reduction in interest rates reducing the cost of capital, the connection of new renewable energy sources and upgrading of transmission infrastructure, as well as the adoption of a new cadastral system key to facilitating new mining rights in a cornerstone of the South African economy which drives demand for heavy machinery and industrial equipment.

Let us guide you

There continues to be strong M&A activity within Industrials Capital Goods sector with renewed interest from both international and local players. Should you be looking to Raise Capital, bring on a Strategic Equity Partner, or make a Full or Partial Exit, we are well positioned to assist you in reaching your strategic goals and achieving the best outcome.

As leading corporate advisor since 2002, we are advising on various transactions in this space and through our proprietary sell-side process have successfully guided the Isotec Group on their sale to Hudaco Industries (JSE:HDC) which was recently announced in January 2025 for R709 million.