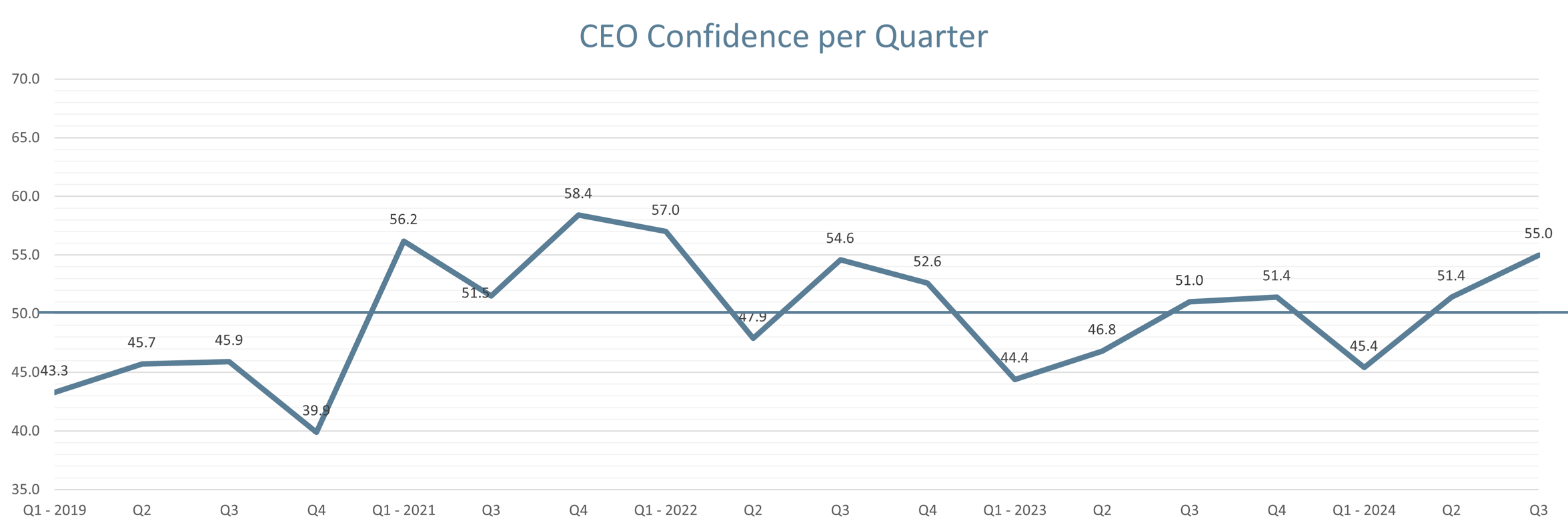

The Merchantec CEO Confidence Index has recorded a 7% increase in CEO confidence in Q3 of 2024, rising to a score of 55.0. This improvement reflects a cautiously optimistic outlook among South African business leaders, spurred by positive developments in the formation of the business-friendly GNU, and the recent reliable electricity generation, however, CEOs realise there is still a lot of work to be done to reduce Government spending and inefficiencies, interest rates, crime and policy uncertainties.

Looking ahead, the majority of CEOs anticipate a GDP growth rate of 1.5% for 2025 which aligns to the South African Reserve Banks forecasted GDP growth rate. Despite economic, governmental, and regulatory challenges, there is an underlying hopeful sentiment for significant advancements in governance and infrastructure to support economic development.

Overall, 65% of CEOs perceive current economic conditions and industry growth expectations to be moderately to substantially better compared to 6 months ago, while 68% of CEOs also have moderately to substantially higher growth expectations for their company.

The rise in confidence among business leaders is positive, as it is likely to drive higher levels of investments in areas such as capital expenditure, personnel expansion, acquisitions and more.