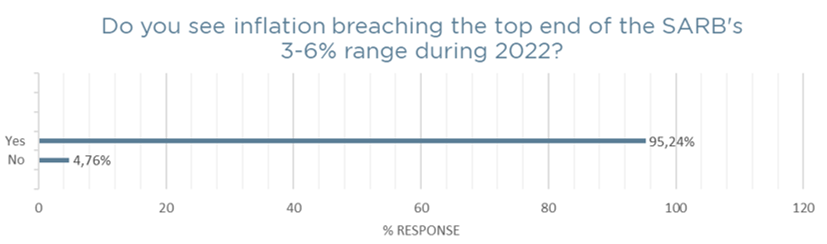

Our latest CEO Confidence Index indicates that 95,24% of CEO’s believe inflation will breach the top end of the SARB’s 3-6% range in 2022 resulting primarily from concerns surrounding the international conflict arising from Russia’s invasion of Ukraine and the ramifications for the South African economy. However, the basic resources sector is particularly robust with the highest recorded CEO confidence on record for the sector.

The basic resources sectors’ leap in confidence is attributed to strong commodity prices, reflective of the increased demand for resources. Fuel and oil prices are the primary factors influencing inflation, with CEO’s stating that the domino effect of rising fuel prices could lead to further issues in an economy barely recovered from the Covid-19 pandemic. Likewise, political dissatisfaction is a major theme, with CEO’s raising concerns over general mismanagement and corruption, all of which could have serious implications for international investor confidence.

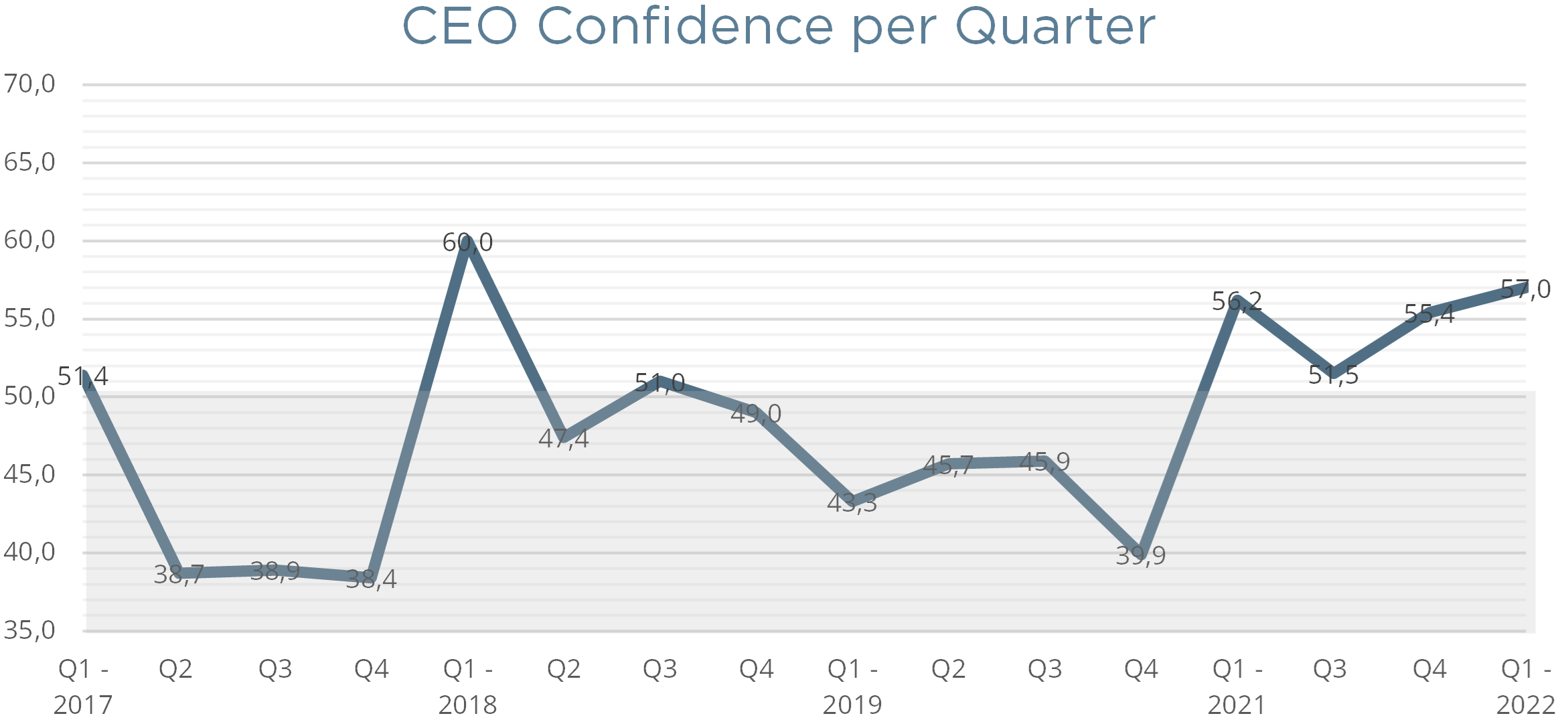

The Merchantec Capital CEO Confidence Index in Q1 scored 57, continuing a rise from the slight slump experienced in Q2 of 2021. The score is one of the highest in recent years, second only to the confidence score of 60 in the first quarter of 2018, which is attributed to the election of Cyril Ramaphosa as president in the 2018 elections. The basic resources sector recorded the largest increase in overall confidence, attributed mainly to improved economic conditions and company growth. Information and Communication Technology recorded the second largest increase in CEO Confidence, indicating the continued growth as technology becomes more integrated into our society.

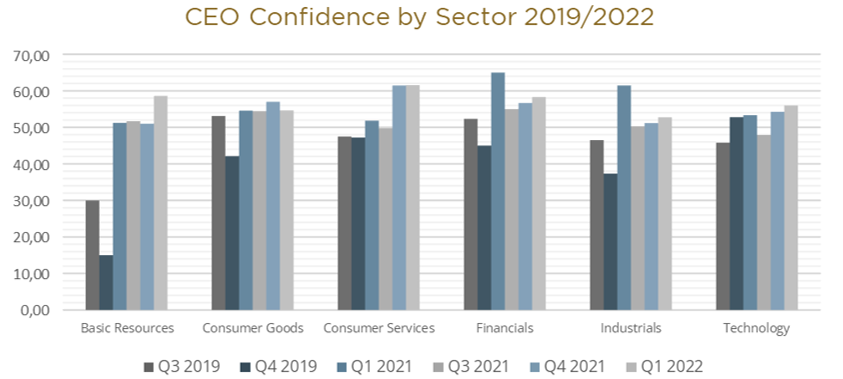

Basic Resources recorded the largest increase of 13.41% in confidence, moving to a score of 58.60 in Q1 2022. This was largely attributed to improved economic conditions, industry growth and prospects of company growth. The increase in demand for basic resources was indicated by exports increasing by 8,5% in Q4 of 20211.

Technology saw the second largest increase, moving to a score of 56. This was attributed to industry growth as well as prospects for company growth, likely driven by the momentum carried through from the rapid digital uptake resulting from the global pandemic2.

Consumer Services recorded a score of 61.56, the highest confidence this quarter. This was attributed to prospects for growth, as well as opportunities for investment. As a result of the national vaccination program, personal services, including health-related activities, continued to increase. The fourth quarter also saw an increase in non-COVID-19 related admissions in various hospitals3.

Consumer Goods saw a 4.14% decrease to a score of 54.64.

Financials saw a slight increase of 2.93%, moving to a score of 58.33.

Industrials scored the lowest in confidence with a score of 52.76. This was driven by the lack of confidence relating the state of the economy and to securing debt or equity capital. However, the score had a 3,07% increase from Q4 2021, indicating a growing confidence.