In this quarter’s CEO Confidence Index, Merchantec Capital announced its commitment to donate R100 to the Nelson Mandela Children’s Fund on behalf of each CEO who completes the questionnaire. Donations will go toward the operation and development of the Nelson Mandela Children’s Hospital, which provides specialised care to South Africa’s underprivileged children. South African CEO’s have unanimously endorsed the company’s decision with an overwhelming response rate.

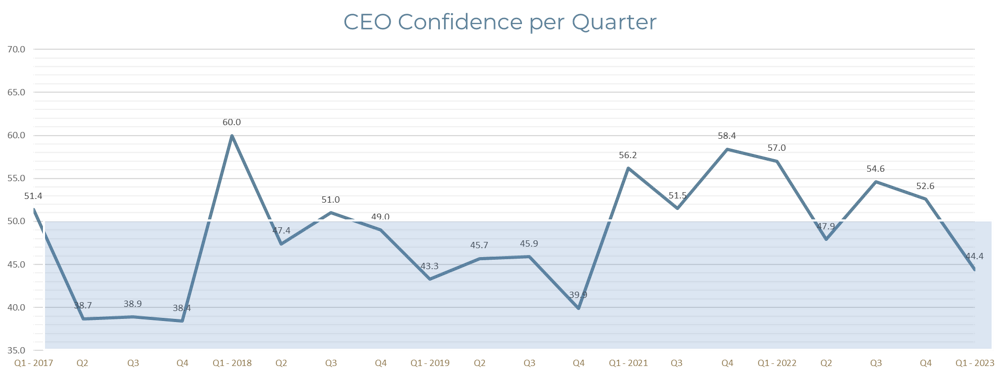

According to the Merchantec CEO Confidence Index, CEO Confidence declined to 44.4 points in Q1 2023, remaining below the neutral score line of 50 points, and the lowest it has been since Q4 of 2019. The decline in confidence reverberated across all sectors and this was largely motivated by the timid state the domestic economy finds itself in.

During the course of Q1 2023, headline inflation has been relatively stable, though it remains at elevated levels, above SARB’s target of 3-6% causing interest rate hikes to try and manage inflation to SARB’s target. South African CEOs feel that load shedding will continue to have a greater negative impact on their business activities and are concerned with governments capacity to address infrastructure problems.

Watch interview with Gareth Edwards from eNCA & Myles Waldeck, Head of M&A Buy Side at Merchantec Capital

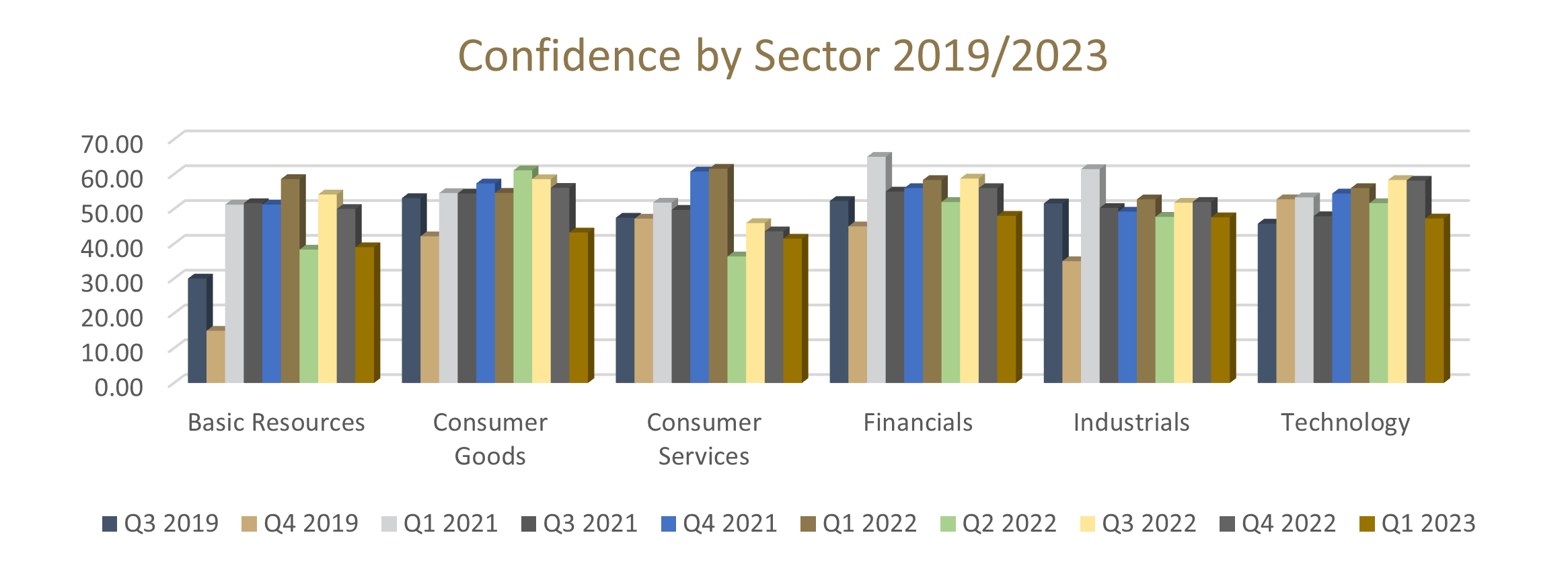

Basic Resources decreased in confidence by 22% to 39 points, compared to a score from Q4 in 2022 at 50 points. The decrease in confidence was generally attributed to lack of confidence in economic conditions.

Technology recorded a decrease of 19% in confidence.

Consumer Goods recorded the largest overall decrease (23%) in confidence with a score of 43.24 points, down from the 64.29 points recorded in Q4 2022. The drop in confidence is attributed to a 18.2% decrease in confidence relating to their ability to secure debt or equity capital, a 20.12% decrease relating to the planned level of investment, a 31% decrease in confidence relating to economic conditions.

Consumer Services saw a slight drop in confidence by 5%.

Financials score decreased, dropping 14.1% from a score of 56 points. The decrease in sentiment was primarily driven by a 35% decrease in confidence relating to economic conditions.

Industrials decreased by 8%. This fall in confidence can be attributed to a 10% decrease in confidence relating to the ability to secure debt and equity capital, and a 2% decrease in company growth expectations.