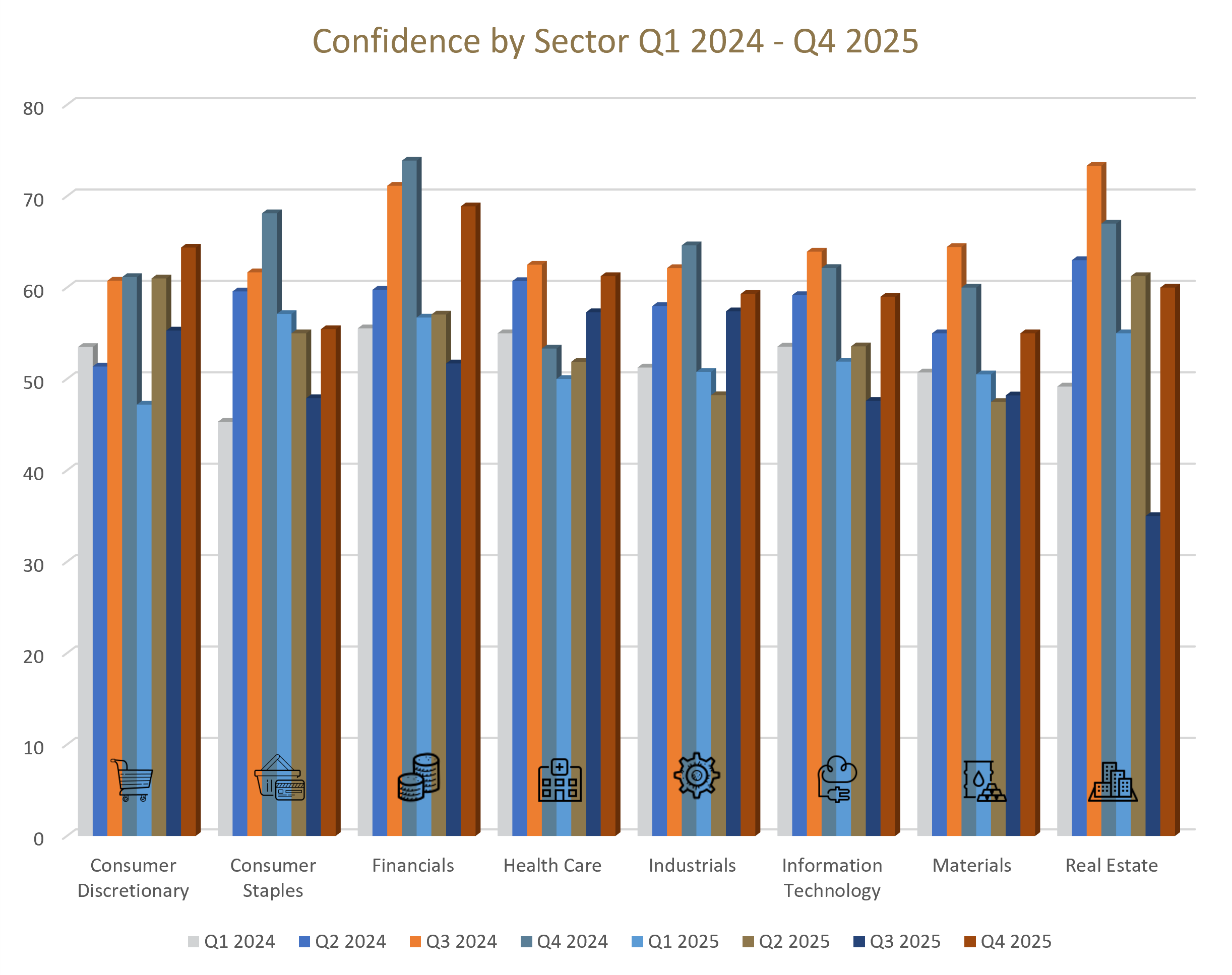

Sector-Specific Insights:

Real Estate rebounded to 60.0, with leaders citing improved funding conditions and a more positive outlook for property demand. While the residential market shows clear signs of recovery, some uncertainty remains in the commercial segment. This recovery is visible in areas like Sandton, where new residential and mixed-use projects are reshaping the skyline, signalling renewed investor and developer confidence.

Consumer Discretionary rebounded to 64.4 in Q4. CEOs reported stronger investment sentiment and a pickup in consumer demand, though some caution remains around costs and competition. The sector ends the year on a more optimistic note.

Consumer Staples rebounded to 55.5 in Q4. CEOs reported stabilizing input costs and gradual improvements in supply chains, though demand remains subdued in some categories. Many leaders are cautiously optimistic, noting that efficiency gains and cost management are starting to pay off.

Financials led the pack, surging to 68.9, the highest among all sectors. CEOs cited improved credit conditions, robust investment sentiment, and renewed optimism in lending and capital markets. The sector benefited from increased deal activity and a more favorable regulatory environment.

Health Care continued its upward trend, reaching 61.3. Leaders highlighted increased demand for health services, ongoing innovation, and sector-specific opportunities. Investment in new technologies and expansion of service offerings contributed to the positive outlook.

Industrials climbed to 59.3, reflecting resilience and increased project activity. CEOs pointed to better-than-expected demand in several sub-sectors and noted that investment sentiment has strengthened as supply chain disruptions eased.

Information Technology advanced to 59.0. CEOs reported steady deal flow, strong demand for digital solutions, and growing confidence in the sector’s innovation-driven growth. Many organisations are ramping up AI and automation initiatives.

Materials rose to 55.0, with CEOs pointing to stabilisation in commodity prices and renewed export opportunities. However, concerns about global market risks and fluctuating demand persist, keeping sentiment measured..

Utilities climbed to 61.0, reflecting improved infrastructure investment and a more stable regulatory environment. CEOs remain cautiously optimistic, but note that long-term challenges, such as aging infrastructure and regulatory complexity persist.