Series 1: Article 7

JSE Aiming at Cutting the Red Tape

Authority to Issue Shares for Cash & Bookbuilds – JSE Aiming at Cutting the Red Tape

In our seventh and final article entitled “General Authority to Issue Shares for Cash & Bookbuilds”, the Merchantec Capital Sponsor Team completes its Series “JSE Aiming at Cutting Red Tape”.

In seeking to do away with unnecessary “red tape”, the JSE’s March 2021 Consultation Paper focussed on “effective and appropriate level of regulation”, wherein amendments around, inter alia, “General Authority to Issue Shares for Cash & Bookbuilds” were proposed.

Before we consider the proposed amendments, let’s look at the Current Listings Requirements’ provisions

An issue of shares for cash, either in terms of a general or specific authority or as a vendor consideration placing, is one of the most effective capital raising methods available to Issuers. In terms of the Listings Requirements, an issue for cash requires the approval of at least 75% of all shareholders, excluding participants and associates, as the case may be.

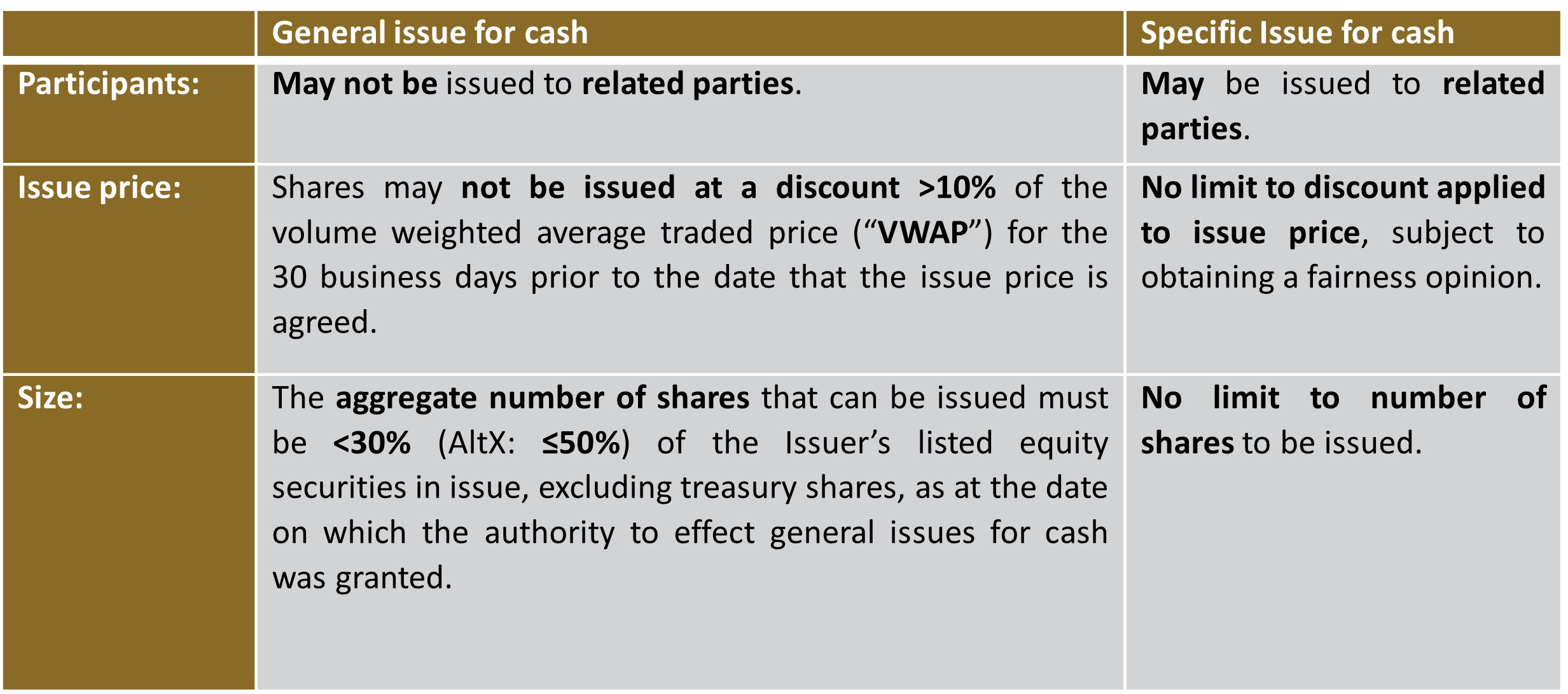

The principle differences between a general and a specific issue for cash are set out below:

Background to the proposed change – the Bookbuild Process

One of the most prominent and expedient capital raising methods currently being employed by Issuers is the Bookbuild process on an accelerated basis, which is typically completed within eight hours.

A Bookbuild is a process through which investor-demand from select participants is generated and captured as a book of demand is built. This forms the basis for raising capital by way of an issue of shares for cash.

The objective of such a mechanism is to achieve the best price through a bidding process by selected participants, leading to active price formation.

However, oftentimes anchor investors – who are in many cases an obvious source of capital for an Issuer – are holders of >10% of the share capital and are therefore defined as related parties. Given that the Listings Requirements currently prohibit related parties from participating under a general issue for cash authority, the benefits of an Accelerated Bookbuild are severely limited because potential participants interested in providing capital to the Issuer are excluded.

What has been proposed?

The JSE is proposing to amend the constraint on capital raising under a general issue of shares for cash authority so as to allow related parties to participate in an Accelerated Bookbuild subject to the following:

- related parties may only participate in a Bookbuild capital raising process by submitting a bid “at best” where they are excluded from the price formation bidding process but may take up shares once the final issue price has been determined upon the completion of the Bookbuild process;

- the pricing parameters applicable to a general issue of shares for cash pursuant to paragraph 5.52(d) of the Listings Requirements, being a maximum discount of 10% of the 30-day VWAP of such shares will continue to apply;

- clear disclosure of the Bookbuild process, which at a minimum must state that the placement under a general authority is only open to related parties who bid without specifying a bid price, and on the basis that they will accept the price at which the book closes ie. supply is matched or exceeded by demand; and

- shareholder approval must be obtained where it is clearly stated that, if an Accelerated Bookbuild capital raising mechanism is used under a general authority to issue shares for cash, related parties will be able to participate as proposed above.

This will allow related parties to take up shares under a general issue of shares for cash authority through an Accelerated Bookbuild process, as price takers (at best) only, and not as price makers.

What is the JSE’s rationale for the proposed amendment?

The JSE recognises the benefits and popularity of Bookbuilds as capital raising mechanisms and the inclusion of related parties, where their ability to influence pricing, is minimised. Additionally, related parties will have the opportunity to directly participate in the issue of shares for cash at their option.

Let us facilitate your Accelerated Bookbuild

As our Series comes to a close, we invite you to rate the Merchantec Capital Sponsor Team’s Articles on a scale of 1 to 10, with 10 being most beneficial and/or informative.

We look forward to receiving your feedback.