80% of CEOs believe that the ANC’s support will fall below 50%

In this quarter’s Merchantec CEO Confidence Index, CEOs were asked about their predictions on political developments: “Will the ANC’s support fall below 50% in the upcoming elections?” An overwhelming 79.7% of CEOs indicated that they believe it will.

The responses highlighted a shared concern among CEOs over the current political direction and its impact on the business climate. A significant number of leaders expressed a desire for change, with some calling for economic reforms and a pivot away from ideologies seen as detrimental to market freedom. “We need to allow the free markets to take the reins. Privatise all SOE’s,” one CEO stated, reflecting a wider sentiment for change.

Several comments focused on the importance of voter demographics, with hopes that the younger generation will become more politically active, and the older generation will reconsider their longstanding loyalties.

Anticipation of an ANC-led coalition, has raised concerns about further entrenching anti-business sentiment, which could worsen the outlook for South Africa.

These findings come at a crucial time as the country prepares for its upcoming elections. The business community’s perspective, as captured in this quarter’s CEO Confidence Index, is a call for political change and economic revitalisation.

The Merchantec CEO Confidence Index recorded a 3% decrease in CEO confidence in Q1 of 2024 to a score of 45.4, which is below the neutral score line of 50 points. The largest contributor to this decrease in confidence was the planned level of investment across all sectors.

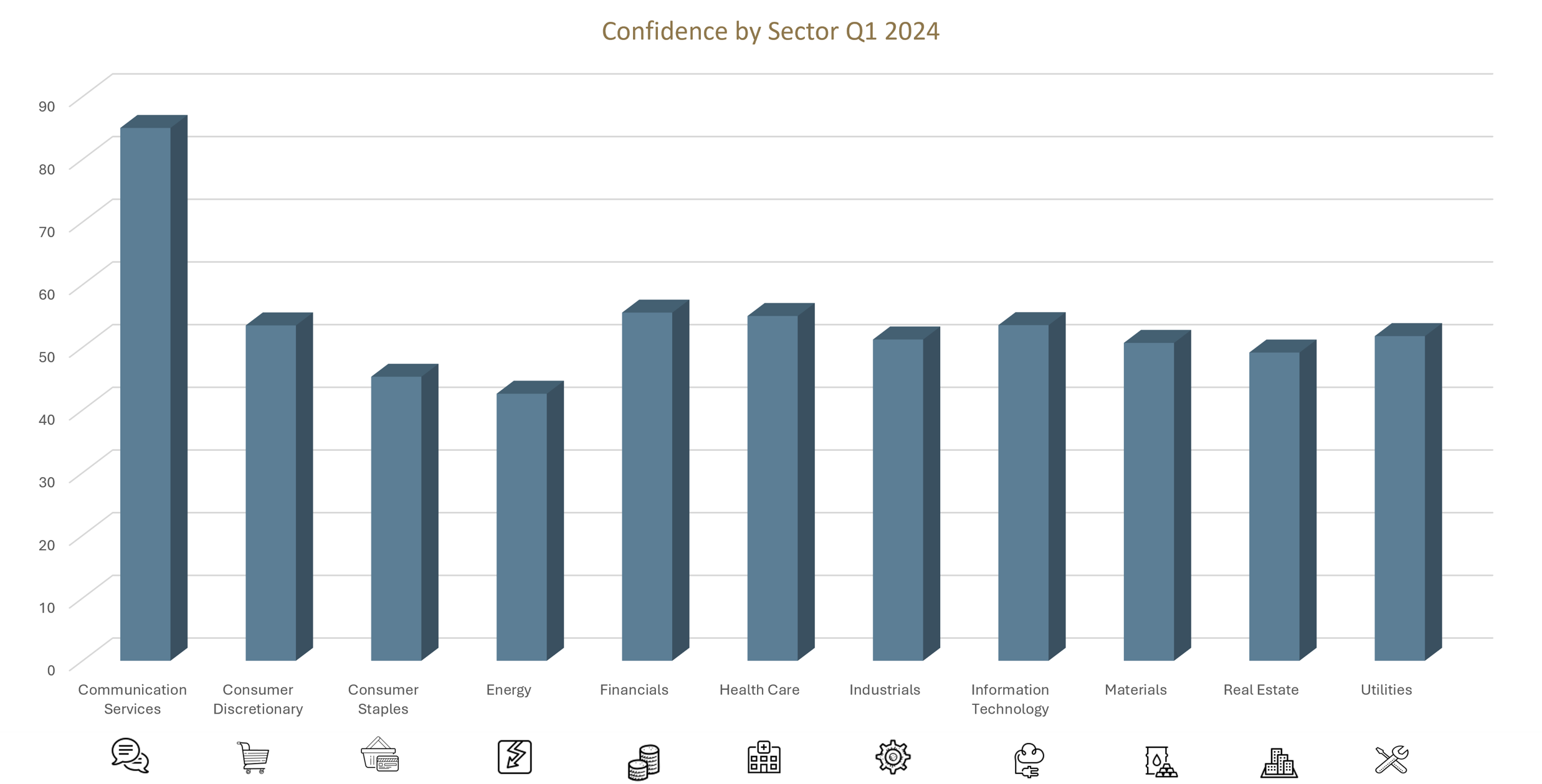

The Merchantec CEO Confidence Index has been updated to be aligned with the latest General Industry Classification Standards (GICS) governed by S&P and MCSI. The updated Classification now spans over 11 industries classifications rather than the previous 6 overarching industries.

By aligning the Merchantec CEO Confidence Index with the latest GICS, readers and users will enjoy an enhanced interpretability of the findings which will more accurately align with the familiar and relevant practices of the investment industry.

Materials increased in confidence by 6% to 50.71 points, compared to a score from Q4 in 2023 at 47.86 points. The increase in confidence was primarily driven by industry growth expectations.

Information Technology went down in confidence to a score of 53.54 points, reflecting a 26% decrease from the highest score in Q4 of 2023, which was 72.50

Consumer Staples decreased by 33.12%, moving to a score of 37.35. The decrease in overall confidence was primarily driven by economic conditions.

Consumer Discretionary recorded an increase of 19.3%, this was driven predominantly by industry growth.

Financials increased by 7%, moving to a score of 55.54 from 51.79 in Q4 of 2023. The increase in overall confidence was primarily driven by an increase in economic conditions and company growth.

Industrials recorded an increase in confidence of 25%. This rise in confidence can be attributed to a 50% increase in confidence relating to industry growth expectations, despite the 36.1% decrease in planned levels of investment.

Utilities remained flat at 40.25.

Communications Services recorded the largest increase in confidence at 44.7%, moving to a score of 85. The increase in overall confidence was driven by increases in contributing individual components of the index, 42.5% increase in relating to industry growth expectations. Confidence increases in the ability to secure debt or equity capital by 22.6%, and overall improving economic conditions by 22.3%, despite the 8.9% decrease in planned levels of investment.

Health Care went up to a score of 55.00 points, a meagre 1% increase.

Real Estate Increased by 5.8%. Sentiment was primarily driven by a 10.9% increase in confidence relating to the ability to secure debt and equity capital and a 6.8% increase in confidence in economic conditions.

Energy saw a 12% increase . The improvement in sentiment was primarily driven by a 34.1% increase in confidence in relation to economic conditions.